We are at a pivotal point for rare earths.

MP Materials, the only US-based source, just made history.

They are worth +$12 billion after cornerstone deals with the US Department of Defense and Apple.

Let’s start at the end.

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

Apple $AAPL agreed to buy $500 million in their magnets, slated to begin in 2027. The deal provides a steady ex-China flow, ergo, with plenty of the geopolitical benefits.

But $MP hasn’t made a single magnet yet!

Enter DoD…

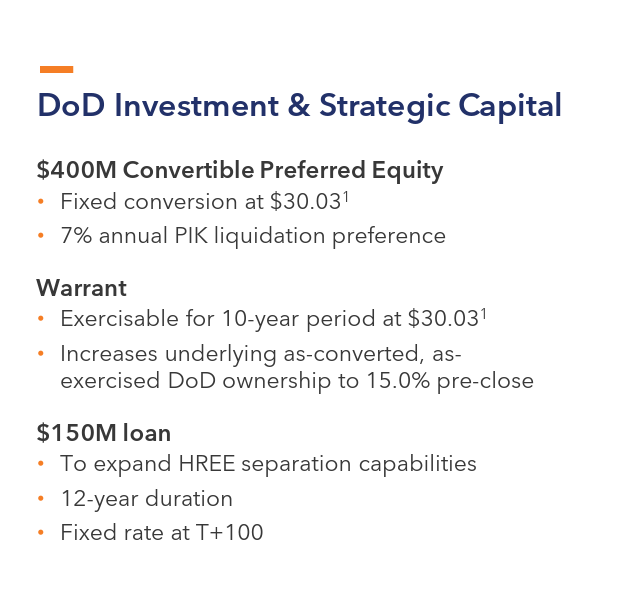

The Department of Defense committed $400M, becoming the largest shareholder. The deal comes with some extra sprinkles, including a $150M loan.

All extremely transformative.

But the piece de resistance? It relates to price.

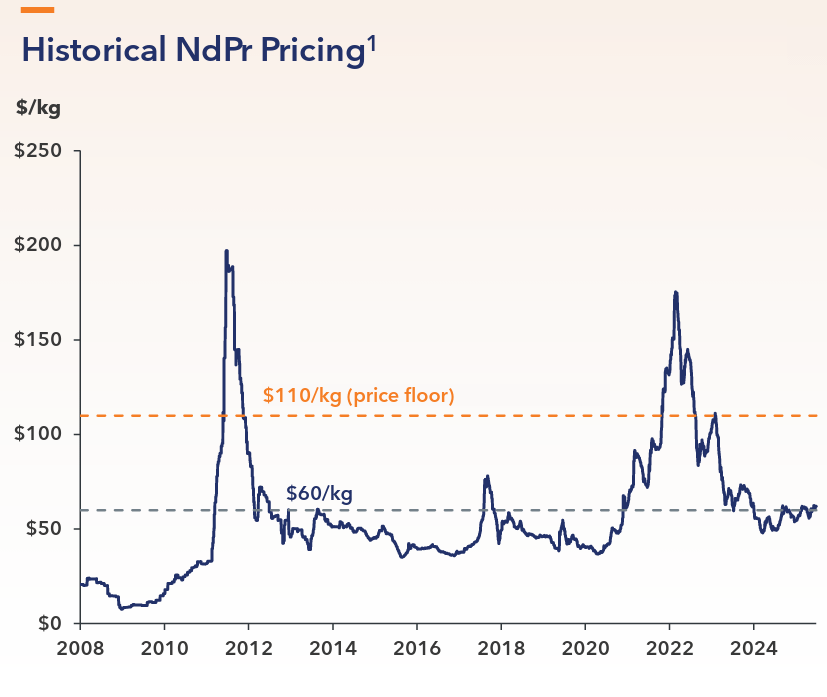

REE pricing has made new production from the West extremely challenging and in cases, a financial disaster. While the desire for more ex-China supply is not new, not much progress has been made in recent years.

So the US government decided it was time to intervene:

The deal gives MP a safety net.

The DoD will pay the difference between the market price and $110/kg of neodymium-praseodymium (NdPr) oxide.

The current price is around $50-52 per kg.

Many experts have voiced their opinions about the need for higher prices, including Benchmark (see chart below).

The $100/kg NdPr price level would enable plenty of new mines, and reduce dependence from China.

But this is not just protectionism.

It’s also a sound business decision, expecting returns in a market that given its modest size at ~$8 billion, has the potential to soar, even double by 2034.

But what about Apple?

Apple is paying for magnets. Not minerals.

Well, MP has big ambitions.

BTW, this is their pit at Mountain Pass. A beauty.

They may not have made magnets just yet… but…

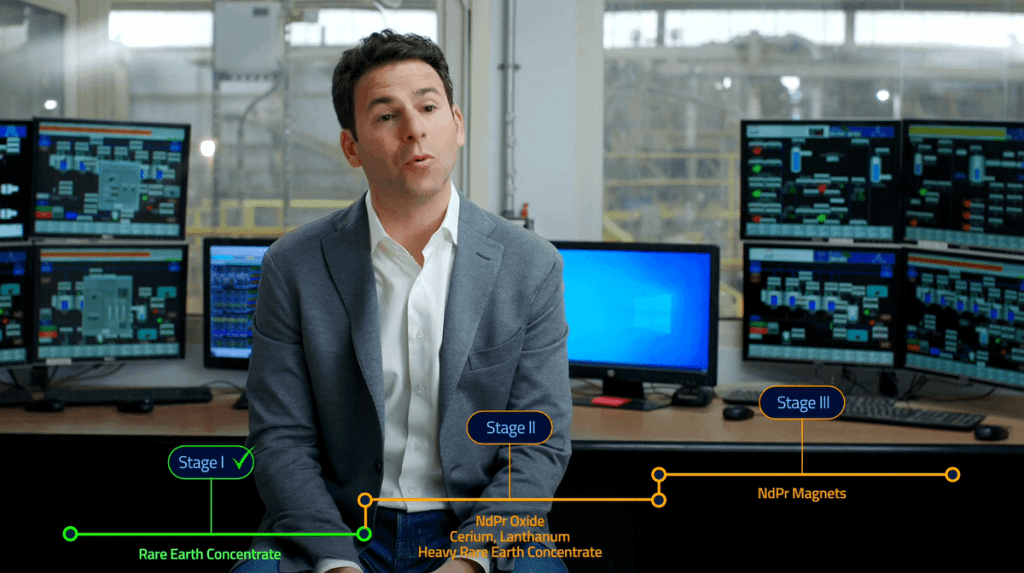

Currently MP produces 15% of global rare earth concentrates, profitably.

The DoD support, plus Apple funding enables their growth plans:

- Stage 1: concentrate ✅

- Stage 2: separate elements, inc NdPr oxide

- Stage 3: Magnets!

The highest value creation is always in end products.

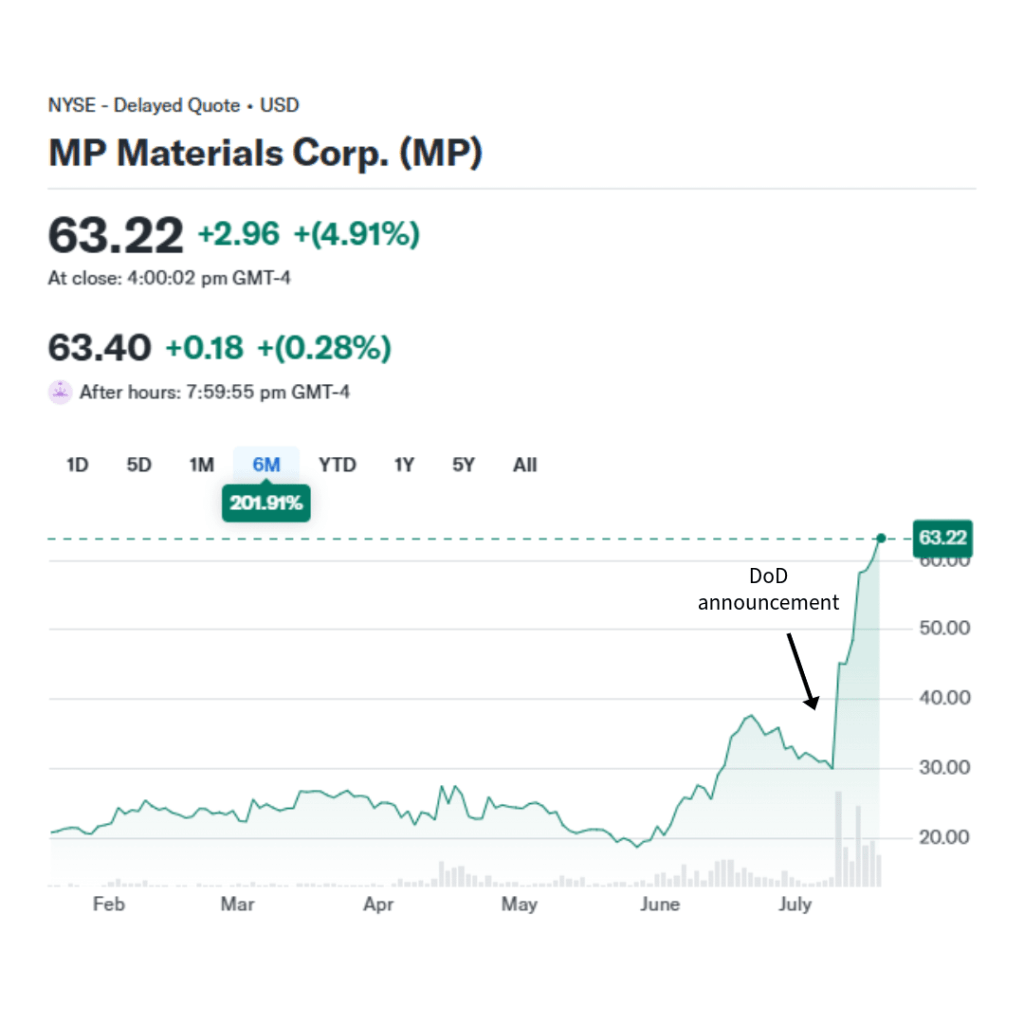

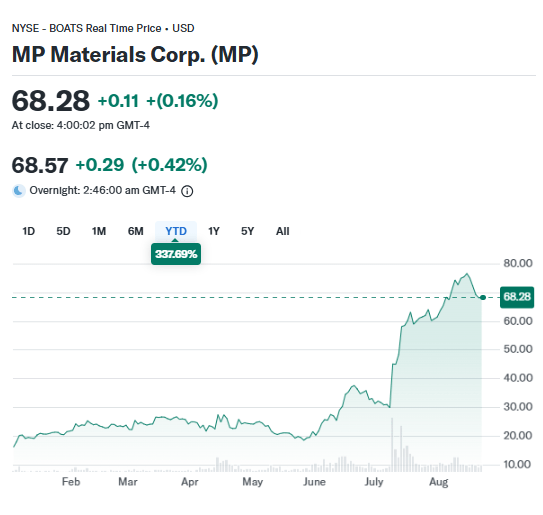

The market reacted FAST.

MP doubled in value within a week, from nearly $5 billion to more than $10 billion, and hasn’t stopped.

Other western peers saw some action including: $LYC $BRE $SGQ $ARU

I see 3 key implications for the REEs outlook after the $MP deals:

- opens the door to more institutional eyes.

- bullish for the space and peers, appreciation across players with assets in the US, Brazil and Australia.

- safety net in the DoD deal could become ‘the price’.

Bright future indeed!

Before we wrap up, here’s a quick background on rare earths:

My final thoughts:

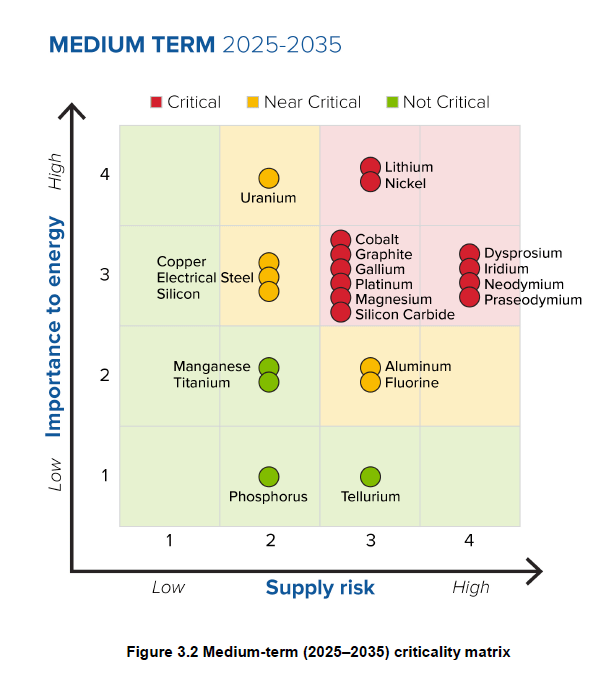

IMO, just getting started for REE. Feels a bit like lithium in 2008. REEs are crucial for many technologies, and have been added to critical mineral lists across the world (see US-matrix below).

PS: Copper carries the juice, and magnets make your machine (car, drone, etc) go. Match made in heaven.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources:

- NdPr market

- Benchmark Minerals

- MP’s intro video

- MP’s Latest presentation