Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

This may be a bit controversial.

As much as I love the mining sector, many things make no sense.

One of them is the common practice of spinning out assets into new vehicles.

Hear me out.

I’m not saying this is never a good idea.

But the sector does it way too often, in my view. I’ve seen it many times, both among our own investments, and as an observer.

It usually goes like this:

- A company stumbles upon a decent asset, in a commodity in high demand (yet not their focus).

- They do some exploration over 12-18 months, and realise the project has real potential, deserving serious exploration efforts. Alas, they still prefer their flagship project.

- So, they decide to spin it out into a new vehicle. Raise some extra funds, and create more value for everyone, right?

Sure, it can happen. And it does.

But it can also add way too much complexity, and even cause both companies to be weaker, especially when the original company is still very small, say under $100M, and the same team will be running both.

Perhaps not enough thought goes into the whole thing, especially during times of extreme market euphoria.

Chasing the newest, coolest thing can be both a smart move and a trap.

Going purely on current sentiment, failing to fully consider the long-term outlook for both commodities and the chance of overstretching operations.

Commodities have cycles, and timing these (as best as possible) is such a crucial part of this business.

I think there’s a huge lesson here.

But let’s put a pin on it for a sec and talk about what we’re paying attention to this week:

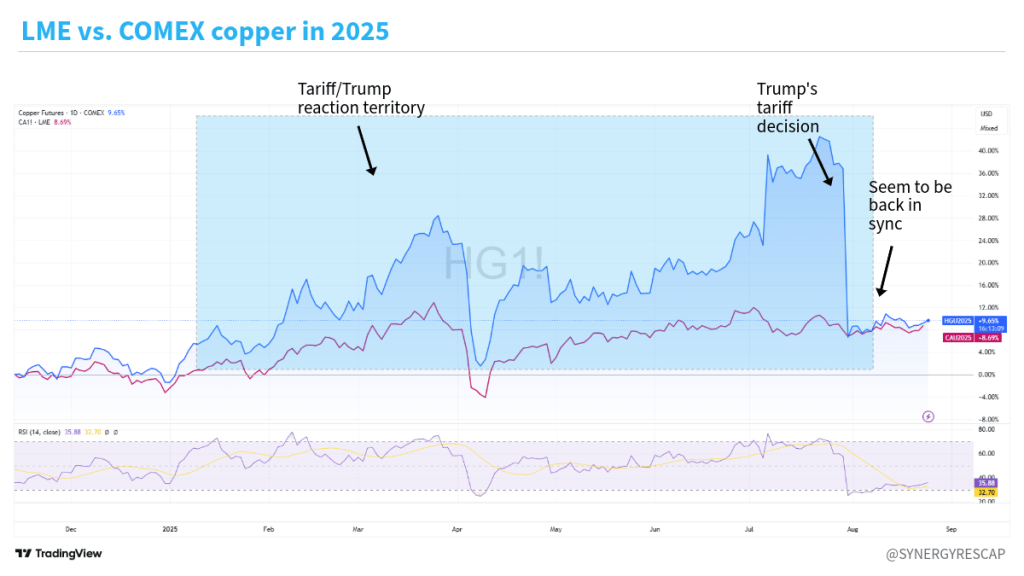

- Copper calm: LME and COMEX seem to be back in sync after Trump’s tariff decision, so expectations are pointing to some quiet times for the metal. Keep an eye, though, for any stress coming from Chile or Peru output.

- Rare earths remain on point: As sentiment for rare earths gains more momentum, most of the stocks we follow in the space remain in green. Important to note that there could be a boom in the making similar to lithium in 2022, as the markets share many characteristics. Public interest remains high, as searches for ‘rare earth’ are even higher than ‘gold stocks’.

- Lithium on the mend: Prices have continued a timid, yet meaningful recovery, so we’re keeping a close eye on price moves and related news. As PLS reported losses, CEO Henderson remains optimistic, and we agree on that (we like brine the best, but potato/potato!).

- Gold and silver keep momentum: Futures sit above $3,400/oz and $38/oz respectively. Meanwhile, UBS lifted 2026 gold forecasts on US macro risks, sees gold averaging $3,600 an ounce — $100 higher than its previous forecast as well as year-end 2025. For June/September 2026, gold prices are expected to rise even further, averaging $3,700/oz.

- Economic calendar: This week we are waiting for Chile’s copper output for July; Chinese PMI; FDI in Brazil; inflation in the US, Australia. Pilbara, Fortescue results due.

- Regulatory: Trump said to be considering using $2 billion in CHIPS Act funding for critical minerals. Mining companies themselves could benefit in similar ways as the MP Materials deal, but also processing and recycling firms. In addition, the US DoD is seeking to buy cobalt for its strategic stockpiles for the first time in decades, which might see cobalt players appreciate.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Equinox Gold Corp. $EQX announces agreement to divest non-core Nevada assets to Minera Alamos for $115M.

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- PC Gold $PC2 is set for a listing on ASX via A$15M raise; their focus is gold in the Northern Territory, Australia. Wallabi Group Pty Ltd, Canaccord Genuity are joint lead managers and the price on listing will be A$0.25/share.

- Almaden Minerals $AMM, a Mexico-focused explorer in the middle of an arbitration dispute, has downgraded from TSX to TSXV and Osisko Metals $OM, a Canadian explorer, has upgraded to the TSX.

- Alkane Resources Limited $ALK is now also listed on TSX. They are a gold and antimony producer recently merged with Mandalay Resources, and holding 3 operating mines plus copper projects in Australia, currently worth over C$1.1B.

- Aura Minerals Inc. $AUGO, a Brazil-focused copper miner, is now also listed on NASDAQ. The company is worth $2B.

- On LSE, First Development Resources plans a $2.3M offer, and Navoi Mining, an Uzbek miner, is planning to list at a $20 billion valuation (latter via Scott North on LinkedIn, huge if it happens).

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements and rating updates

- Lithium Argentina $LAR >> price target raised to $4/share from $2.50, maintained at market perform by BMO

- ST GEORGE MINING LIMITED $SGQ >> dual listing on the Frankfurt Stock Exchange, further expand investor engagement in Europe

- Pan American Silver $PAAS >> appoints Pablo Marcet, an experienced Argentinean geologist and executive, to its board of directors

- Fury Gold Mines $FURY >> Intercepts 41.5 Metres of 1.23 g/t Gold at Sakami Gold Project in Quebec

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Latest alert

Going back to today’s topic…

IMO, if the long-term outlook for one of them is weak and just uncertain to tell, I think a spin-out should be reconsidered.

Would it be better to have some patience and keep the portfolio as is? Or, if capital is constrained, sell the asset to monetise, while keeping some upside exposure in the acquirer without the operational encumbrance?

I’m not saying I have all the answers.

But for investors, it’s important to look deeply into these issues when spotted during due diligence, and for companies, to really have balanced, humble discussions, and take a while longer to think about this when such an opportunity is identified

I’ve seen way too many failed spinouts that should never have happened.

We truly don’t need the extra risk…

Food for thought.

Where do you stand on this one? Would love to hear.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

Extra resources

From the blog

What I’m reading

- The Big Print: What Happened To America And How Sound Money Will Fix It by Lawrence Lepard

- The Diary of a CEO: The 33 Laws of Business and Life by Steven Bartlett

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, NASDAQ, LSE and SRC research. Figures shown in US dollars unless clarified.