Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

You may have seen stories already.

Signs are increasingly suggesting a turning point for lithium.

Back in 2022, lithium miners were rolling in cash because everyone wanted some of their white silvery stuff. Commodities have cycles… and since EV adoption has taken longer than expected, too much supply came online at once, and demand has softened, the sector has been in a rut.

But it may all change very soon.

In fact, we may be on the verge of a pivot, as strong signs of recovery (and likely a bottom) are in.

Jianxiawo, a Chinese mine owned by CATL, was halted due to permit expiry in August. The mine is ~6% of global production, and is expected to be closed for ~3 months.

More mines in China could be affected by the regulatory clampdown, potentially up to 240kt LCE of Chinese lithium supply -equivalent to 15% of global supply- at risk.

As you know, China is a powerhouse in lithium and CATL is one of the largest producers, plus a leader in batteries, supplying major carmakers including Tesla, Volkswagen and Toyota.

Many lithium stocks reacted immediately, including Lithium Americas, Lithium Argentina, Mineral Resources, PLS and Liontown. Prices for concentrate and chemicals have seen a slight improvement.

UBS, on a recent note, points to a tighter supply reality by the end of 2025 and 2026. They have lifted their spodumene prices by 9-32% and carbonate/hydroxide by 4-17% (2025-2028), after finding much bigger supply disruptions brewing. Canaccord hasn’t updated its price sheet just yet (from their global comps), but called the recent low as the bottom and, with new capacity being delayed or cancelled, said they ‘remain constructive on pricing’. View the expanded version on YouTube.

To me, this feels like a turning point.

But let’s put a pin on it for a sec and talk about what we’re paying attention to this week:

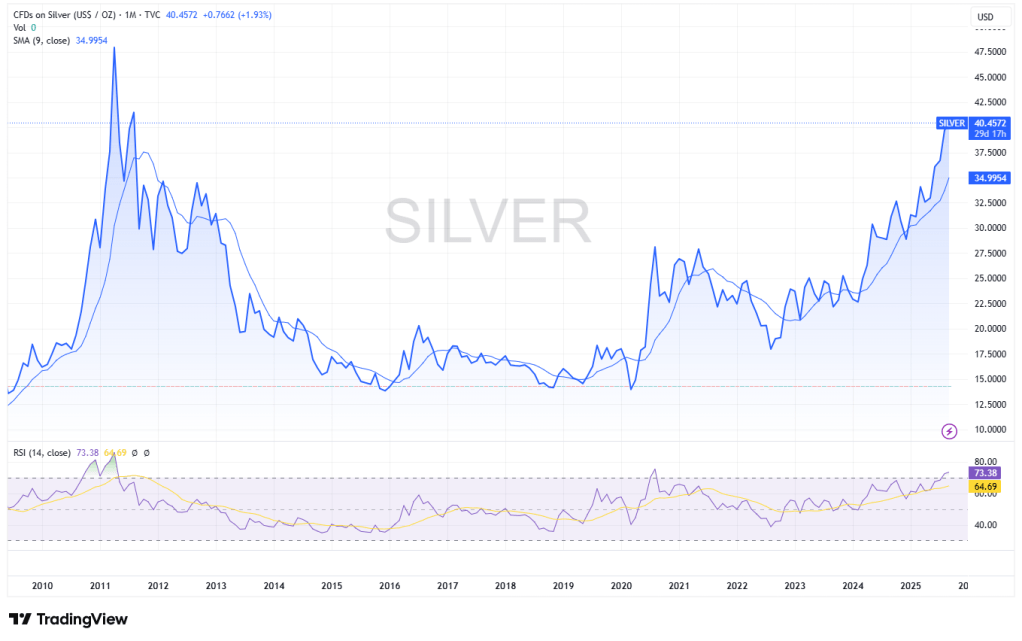

- Silver living: the metal is on a tear, after smashing the $40/oz barrier. But as it is entering overbought territory, it should start to lose steam. We are long-term bullish on silver, so are keen to see any sheen rubbing on some of our picks (like $PAAS and some other midtiers).

- Gold pops: over the weekend, gold crossed again the $3,500/oz level on continued tariff issues, Fed woes. Extremely overbought, in case you haven’t checked.

- Economic calendar: this week starts with a bank holiday in the US and Canada (Labour Day). Manufacturing PMI in the US, Canada, Mexico, Brazil, UK, EU, and Australia plus auto (sales/production) in the US, Brazil.

- Regulatory: Samarco in Brazil gets court approval to exit bankruptcy proceedings after a protracted process, pointing to lower risk in the country; Canada signed a new partnership with Germany to boost mining, energy, and defence co-operation.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Evolve Royalties to acquire Voyageur Explorers in $51M deal

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Ariana Resources Plc $AA2 is set for a listing on ASX via A$15M raise; their focus is a major gold development project in Zimbabwe, gold production in Türkiye and copper-gold, silver and zinc exploration and development projects in Cyprus and Kosovo. Shaw and Partners Limited and Leeuwin Wealth Pty Ltd are Lead Manager/Co-Manager, respectively, and the price on listing will be A$0.28/share. They are currently listed on AIM.

- Dundee $DPM is set for a listing on ASX later this month; their focus is gold in Bulgaria, Serbia, and Ecuador. They are currently listed on TSX and worth over C$4 billion.

Normally, we expect to see a lift in targets and weakness in acquiring parties, and often, peers to targets get some extra love, providing some arbitrage chances. For IPOs, we like to keep an eye on listing day, as any big swings may point to opportunities.

Announcements and rating updates

- Pan American Silver $PAAS >> expects to close its $2.1 billion takeover of MAG Silver on or about Sept. 4 after securing the last approval needed @wsj

- SOUTH32 #S32 >> posts 75% rise in annual profit, boosted by higher prices for its key commodities and higher output of aluminium and copper.

- Collective Mining $CNL >> Colombia recognises tungsten as critical thanks to Apollo discovery

For more deals and commentary, follow us on socials.

For more, join +40K and follow us on socials

Subscriber content

Going back to today’s topic…

Will this stick? Hard to say just yet. This issue could bleed to other Chinese mines, or could get sorted in 1 month.

While this is a reprieve and not a solution, it is still a good sign for those of us who believe in the long-term bull case for lithium. In my opinion, lithium’s time to shine (again) is near.

Where do you stand on this one? Would love to hear.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

ICYMI

If you enjoyed this…

- Invest more confidently with Mining Investing 101

- Become a member for weekly opportunity alerts and access to the whole vault

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, SRC research. Figures shown in US dollars unless clarified.