Newmont is among the top five mining companies and the largest gold producer.

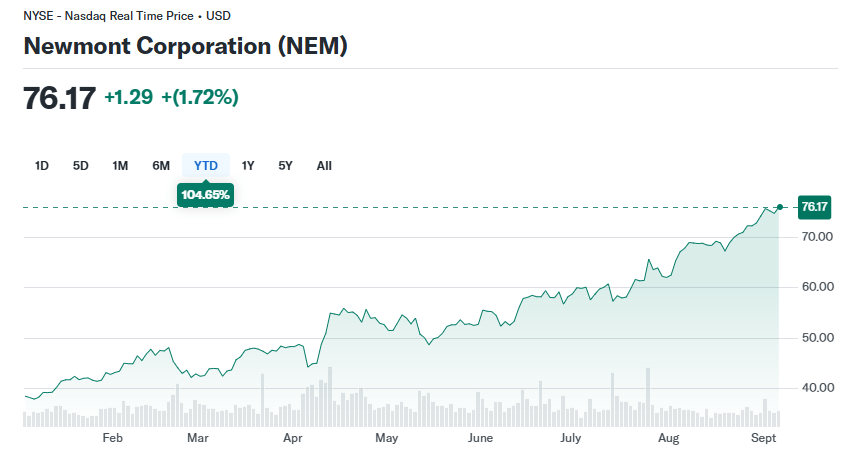

Earnings came higher than expected, pushing its market value beyond $83 billion. Take a look at their chart.

+100% YTD. Juicy. There are many reasons to like them, but here are my favourites:

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

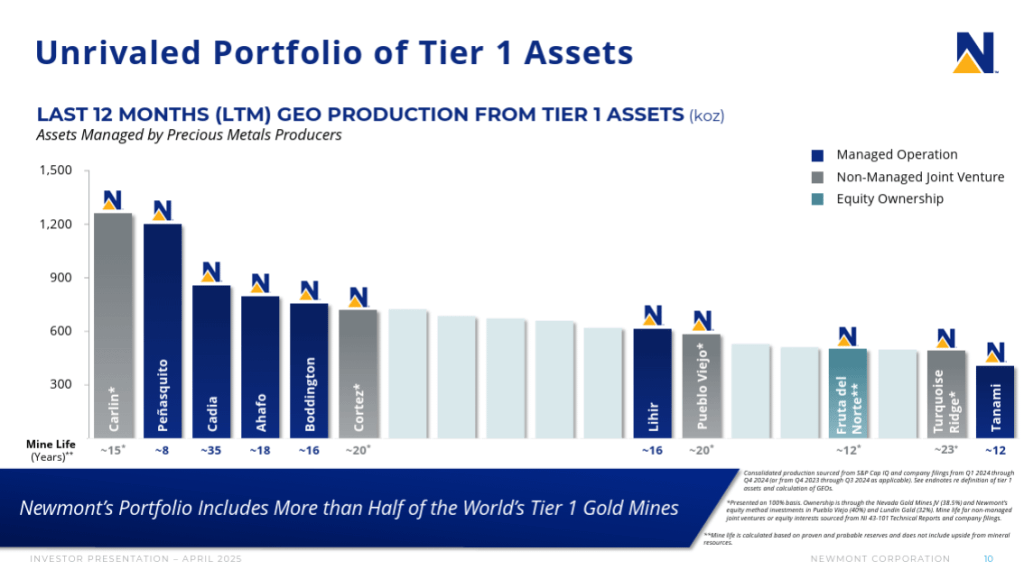

- Great assets

$NEM has an outstanding portfolio of assets, including over half of the world’s tier 1 gold mines.

Most are directly managed, with the remainder via JV or equity participation.

- Location, location, location

A stunning house in a bad neighbourhood can be a nightmare. But not chez Newmont.

$NEM has a clear preference for the Americas and Australia and deep experience operating in these regions.

They are effective scouts, looking at many projects every year (I know from direct experience as they’ve been clients).

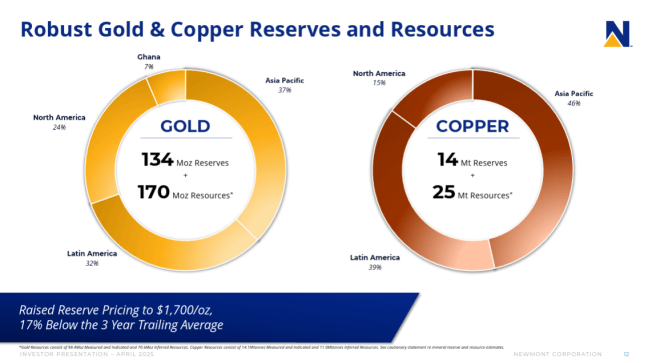

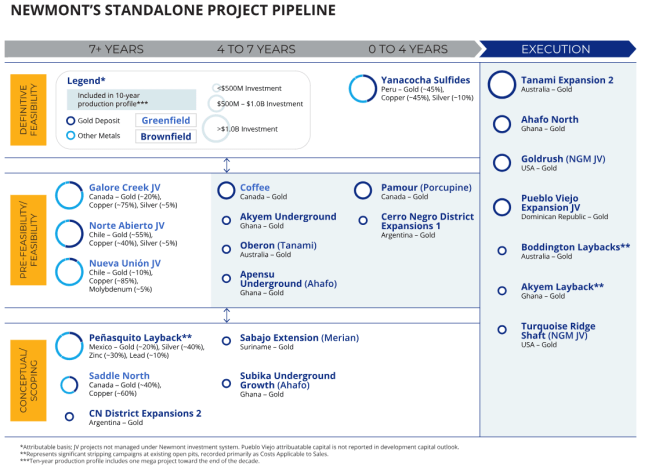

- A healthy stock of minerals and pipeline

Replacing mined reserves is crucial to keep growing.

They have:

- Strong gold and copper reserves and resources across the portfolio*

- Various expansions at existing mines, and some greenfield exploration

- Stuffed pockets

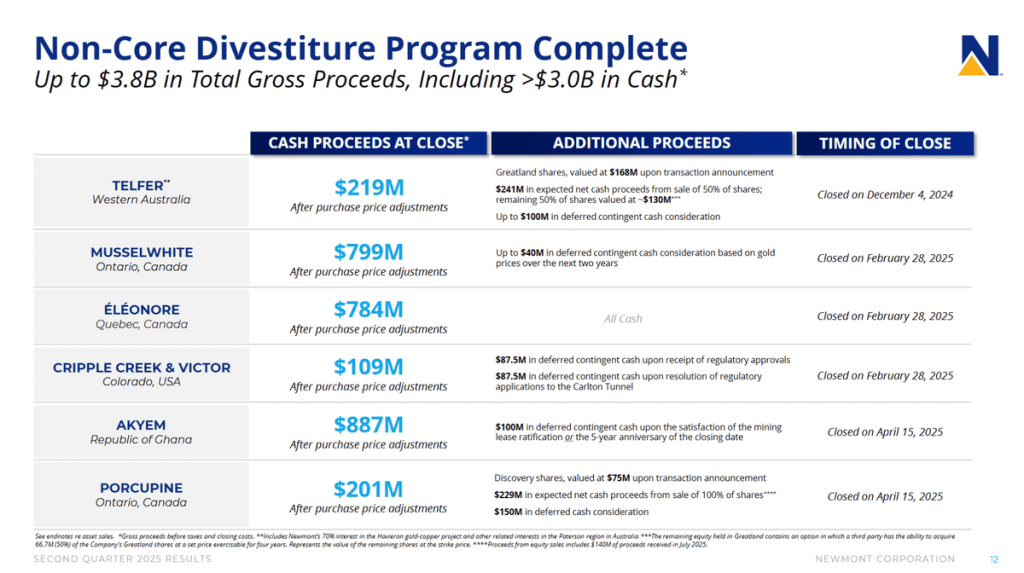

Sales totalled $5.3 billion plus over $3 billion in net cash proceeds from divestitures as it sold several mines, including:

- Telfer in Australia

- Eleonore, Porcupine and Musselwhite in Canada

Enabling a new buyback program on top of dividends.

- Technical competence

And despite a serious accident at the Red Chris mine in BC, they were able to swiftly rescue the trapped miners, showcasing their technical responsiveness.

All in all, a leading player, aiming for the crown.

While $BHP and $RIO have moved mostly sideways, $NEM is soaring.

I believe the run is not over. When I first said this, they were at +70% YTD and look at them now.

I have to admit, I didn’t have to open a position… But they have bought some awesome operations we held, like Brucejack. Jackpot!

And that’s it for today.

And here’s a pro tip:

When you invest in serious explorers/developers, eventually you end up with great producers in your portfolio, often at a fraction of the cost!

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources:

- Investor presentations available here: https://www.newmont.com/investors/events-and-presentations/default.aspx

*unsure if this figure needs updating after final divestments as this chart wasn’t available in their last presentation, will update when I find this out.