Let’s face it. Rare earths are smoking hot.

Apple and the DoD committed over $900M, REE stocks are soaring, and this turn in market sentiment is just the beginning.

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

Before we dive in, I reiterate that:

- the MP deal opens the door to more institutions.

- bullish for the space with appreciation across players ex-China.

- safety net in the DoD deal could become ‘the price’ so much that now even Australia is toying with a similar idea.

To start:

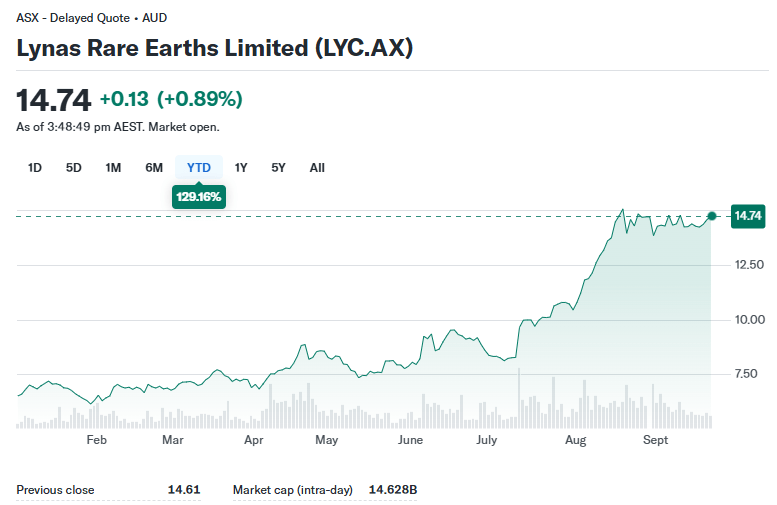

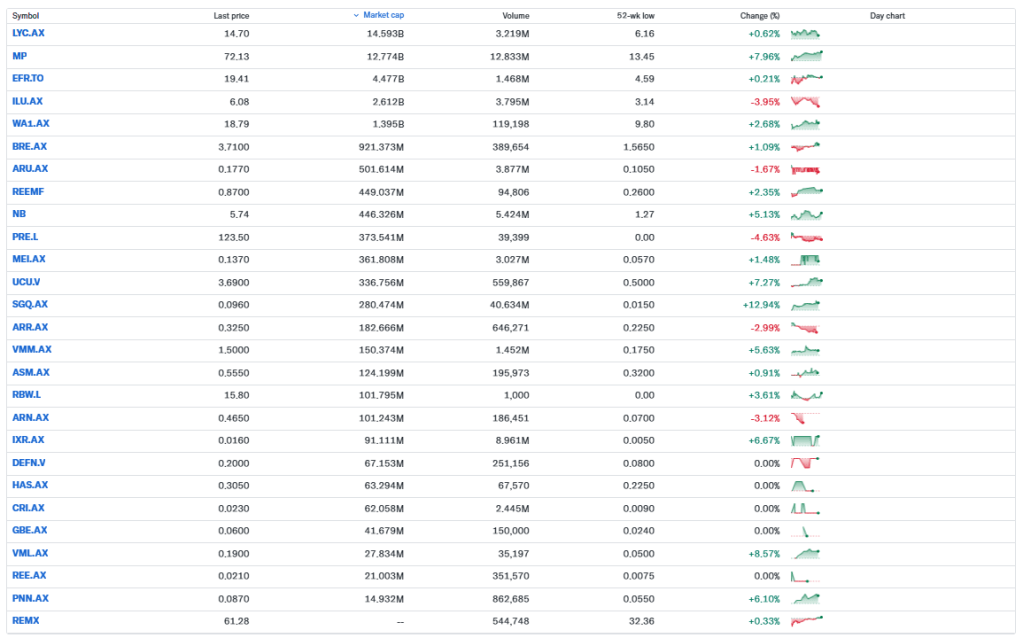

1) $LYC Lynas is the largest ASX-listed peer at A$14bn.

They are up 129% YTD, with nearly half right after the MP Materials deal.

They produce REEs in Australia (with over 20 years of resources ahead), and are expanding in Malaysia, also benefiting from government investment in infrastructure.

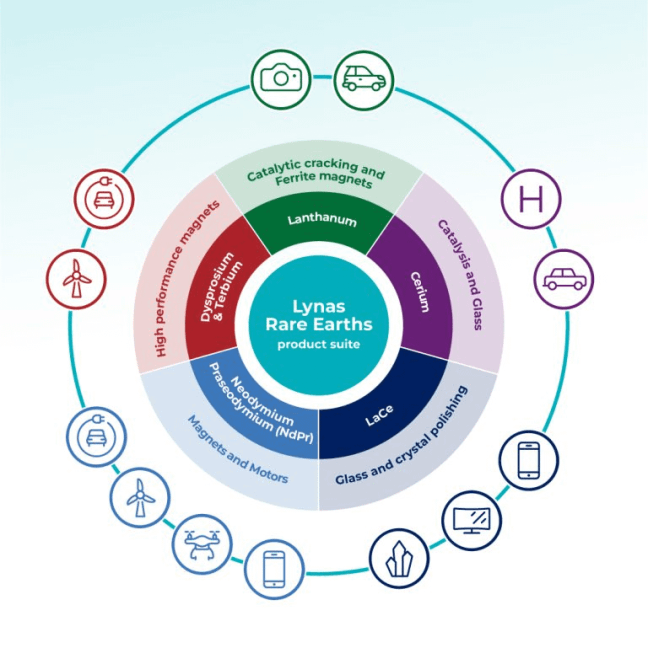

Among their products, they have both heavy and light REEs:

- Neodymium and Praseodymium NdPr

- Lanthanum La

- Cerium Ce

- Mixed heavy rare earths (SEG)

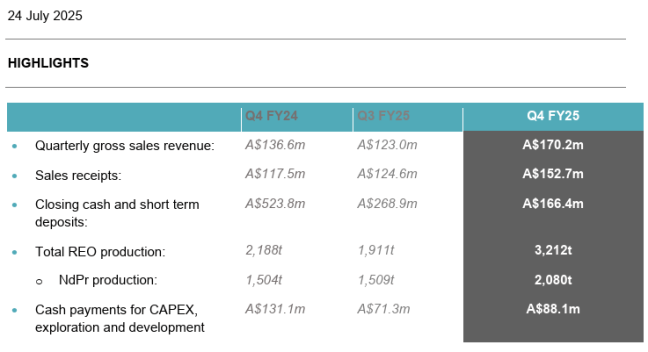

They see sustained growth in what they call ‘a growing and dynamic market’ and are enjoying a healthy cash flow, including A$170M in gross sales revenue in the last quarter.

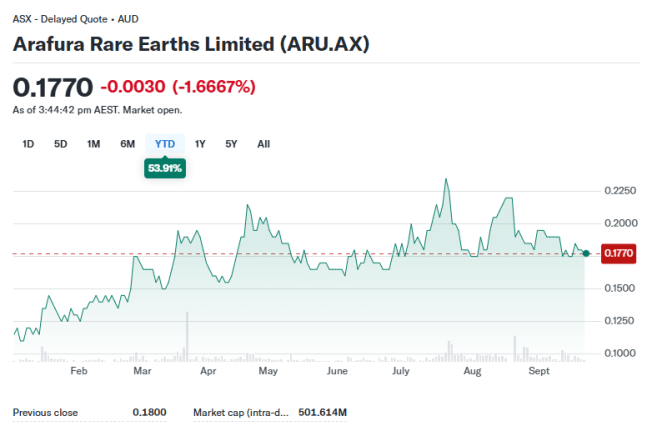

2) $ARU Arafura is up +50% YTD

- 135km from Alice Springs

- Minimum 38-year mine life

- Targeting ~4% of the world’s rare earths magnet supply

- working on their financing (which should be much easier now)

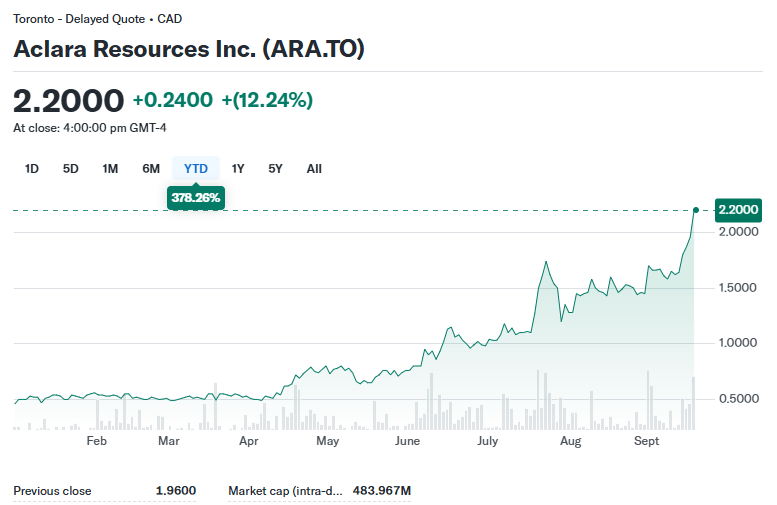

3) Aclara is a TSX-listed, Chile-Brazil-US-focused play.

Up more than 300%.

I looked at their fundamentals here.

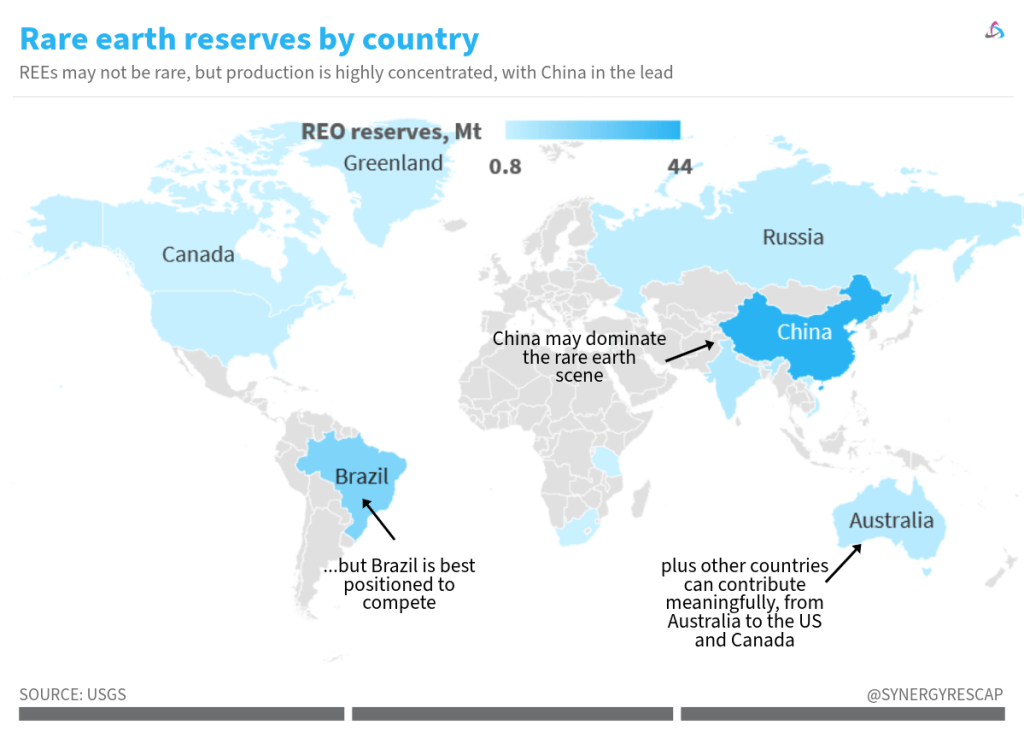

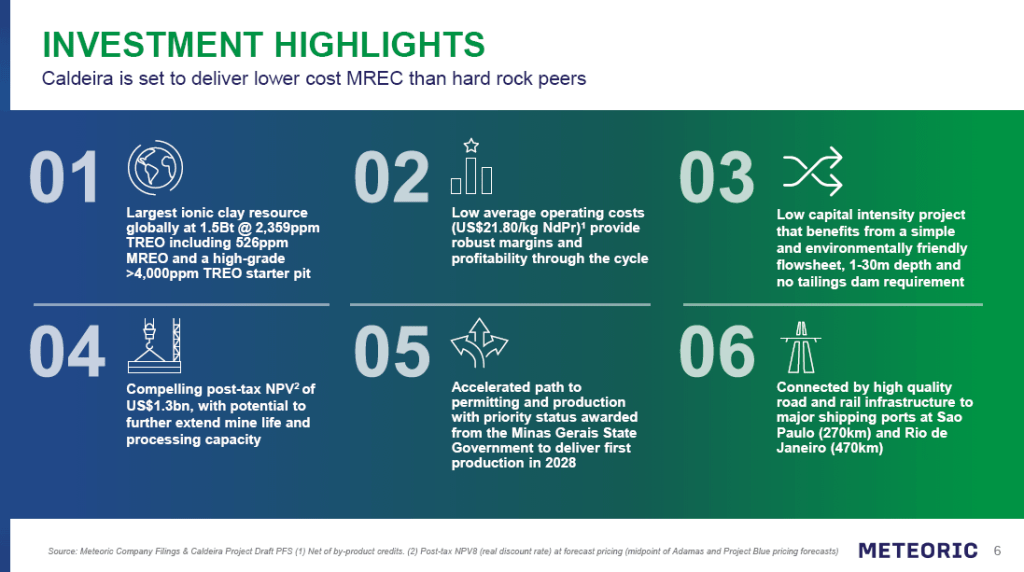

4) $MEI Meteoric is an explorer focused on Brazil.

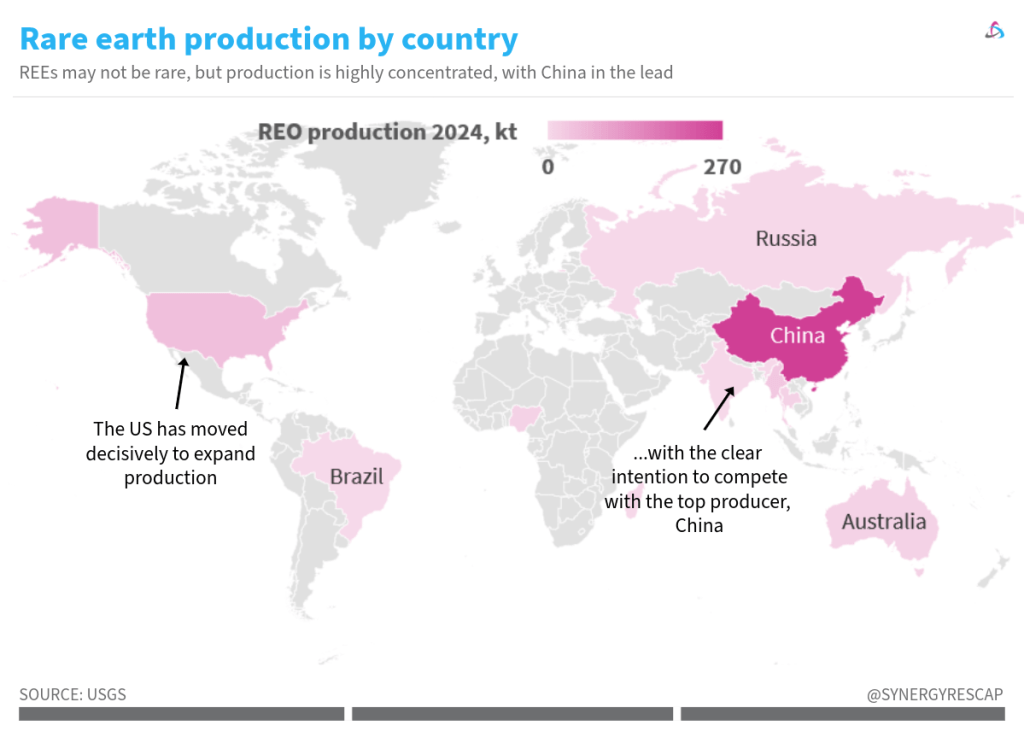

Brazil, as I mentioned, is second globally in reserves. But I digress.

YTD they are up an astonishing 76%, A$395M.

In July, they closed an oversubscribed A$42.5M placement, with strong international support (inc American).

They have, according to their latest presentation, the ‘largest ionic clay resource globally’ at 1.5bn tons TREO, and an NPV of $1.3bn.

The recent placement will be used to reach a final investment decision to develop Caldeira, and they have made progress with their pilot plant.

Note that clay deposits need to be huge and processing is trickier (small particles get everywhere!). From what they share, seems to be going well.

5) St George Mining* is another ASX explorer focused on Brazil (told you, there is a trend here!)

$SGQ is up 52% YTD, and worth A$111M.

The company closed their acquisition on the Araxa project in February, and just raised A$5M to fast-track work, expand drilling, announced an additional discovery and a US-based partnership.

The project has a total resource of 40.6Mt TREO, a 2013 PEA NPV of $967M, with several research reports showing substantial improvement with current metrics.

They could potentially be in production by 2027.

You’ll find regular coverage on them in our feeds.

6) To round up the list, I covered MP Materials in this recent note.

They are the largest, so not cheap at all, but if you’re looking for US-based, they are the best bet, and they have revenue.

Plus, they gained ~2 BILLION since I wrote the original piece!

And here’s your bonus:

A few more players in REE + niobium, including some smaller juniors like $REE and $PNN, and ETF REMX. Remember that smaller is riskier.

This sector is headed for a deep transformation. The global REEs market is valued at ~$2bn yet is forecast to grow to $12bn by 2030*.

The actions taken in the US and other countries may push it even higher. While it seems there will be space for many new players, it is important to consider the dichotomy between hard rock and clay, as each type has its pros and cons.

Get your popcorn or, better yet, research a few players!

And that’s it for today.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Notes: Companies 1-5 ordered by market cap.

Sources: