Teck and Anglo American are two of the world’s largest mining companies.

Combined they’ll be worth over $54 billion, and a copper powerhouse.

Here’s the skinny on the merger:

Get the free newsletter, or pick the paid tier for alerts & tools →

Select ‘glimpse of the newsletter’ and confirm your email.

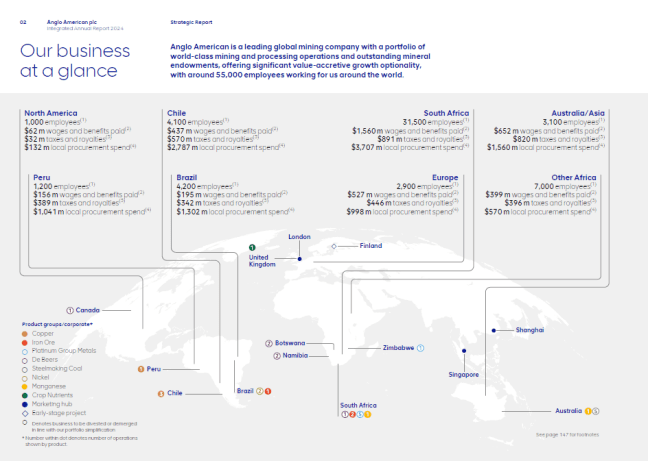

Anglo $AAL is currently among the top 20, ~$30 billion, with $27 billion in revenue last FY.

Teck is a few slots lower, with a market cap of $20 billion and C$9 billion in revenue.

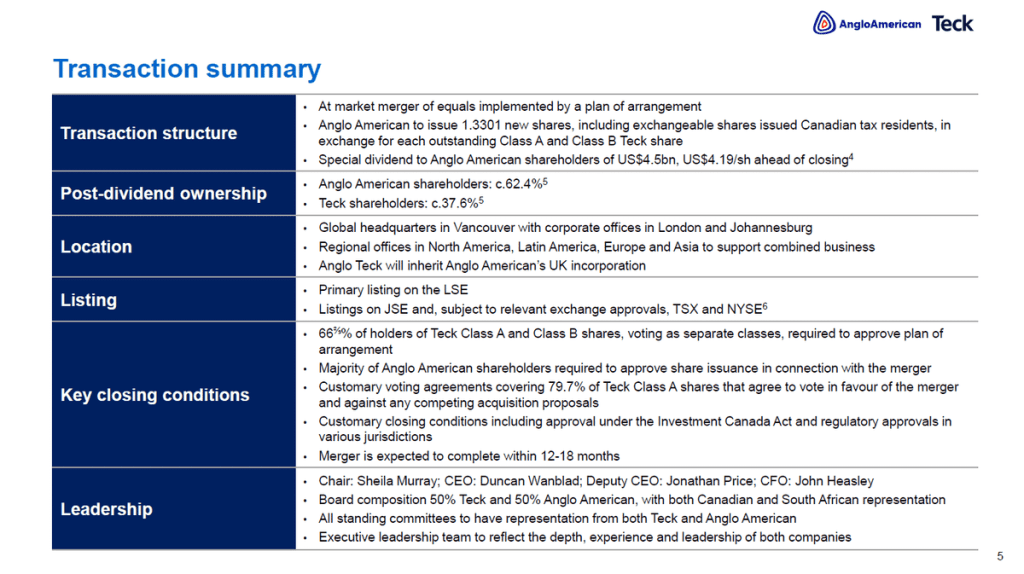

Anglo Teck would have LSE as its primary listing.

The deal comes at a perfect time.

Copper is enjoying momentum and both companies have been busy:

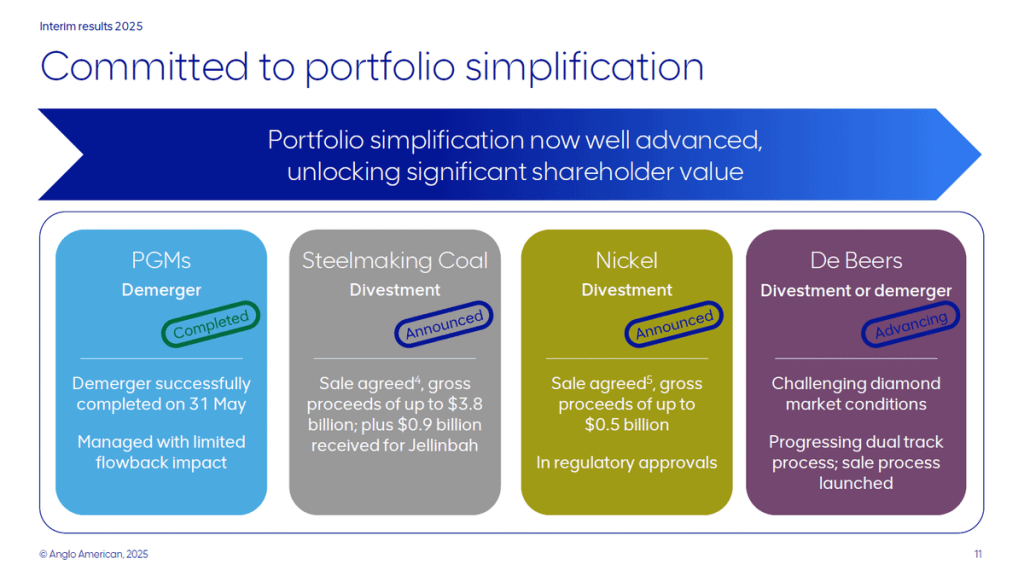

- divesting assets to clean up their portfolios

- building up their copper war chest, and

- reducing costs

For instance, Anglo is set to deliver $1.5 billion in savings this year. They are going through deep changes after turning the business around and fending off $BHP, last year. They already divested PGMs, and are progressing sales of coal, nickel and diamond units.

On the same tack, Teck completed the sale of its coal business to Glencore in 2024.

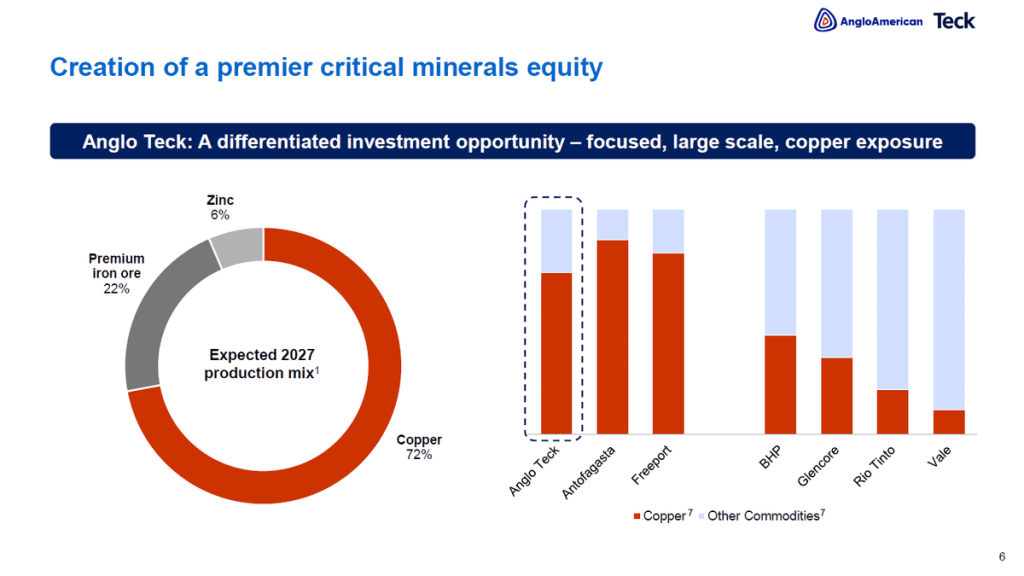

Copper is the main driver behind the merger. The combined entity is set to produce as much copper as BHP and Glencore together, and strongly compete with Antofagasta and Freeport.

Anglo already had >1Mtpa as target, the merger would push them up to ~1.35Mt.

Iron ore and zinc round up the play.

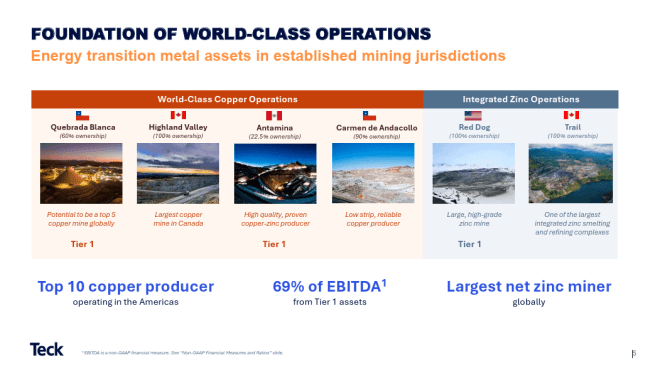

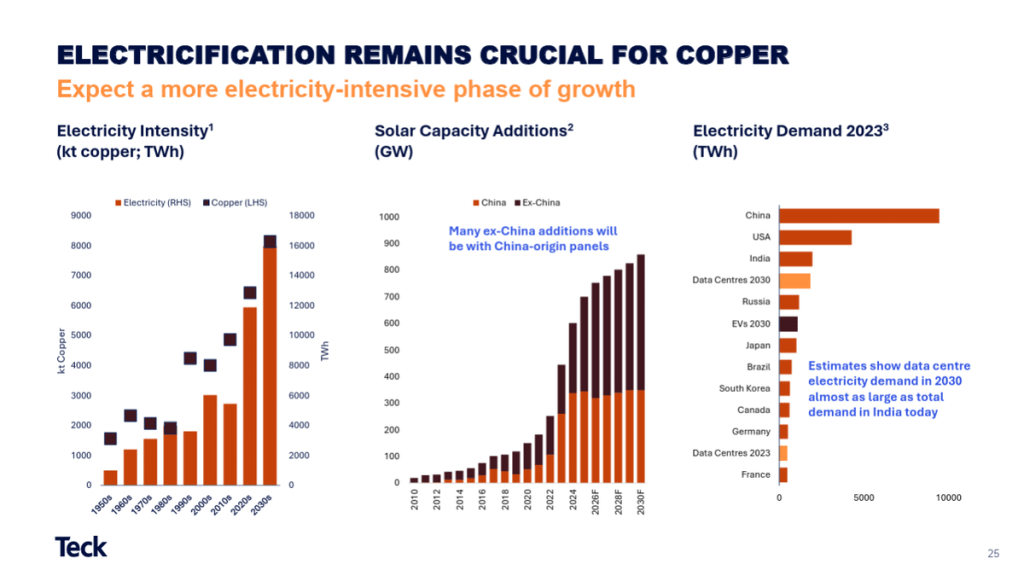

You could say they are bullish on copper! Teck previously highlighted the role of copper in growth.

The more the world grows, the more energy it needs, ergo, more copper. And it’s set to become even larger than first anticipated, with solar expanding (but not only in China).

Anglo’s portfolio has a lot of goodies globally. But the ‘jewels’ are the Chile/Peru copper mines and smelter. Teck operates in many of the same countries.

And this is crucial for the decision to merge, I believe.

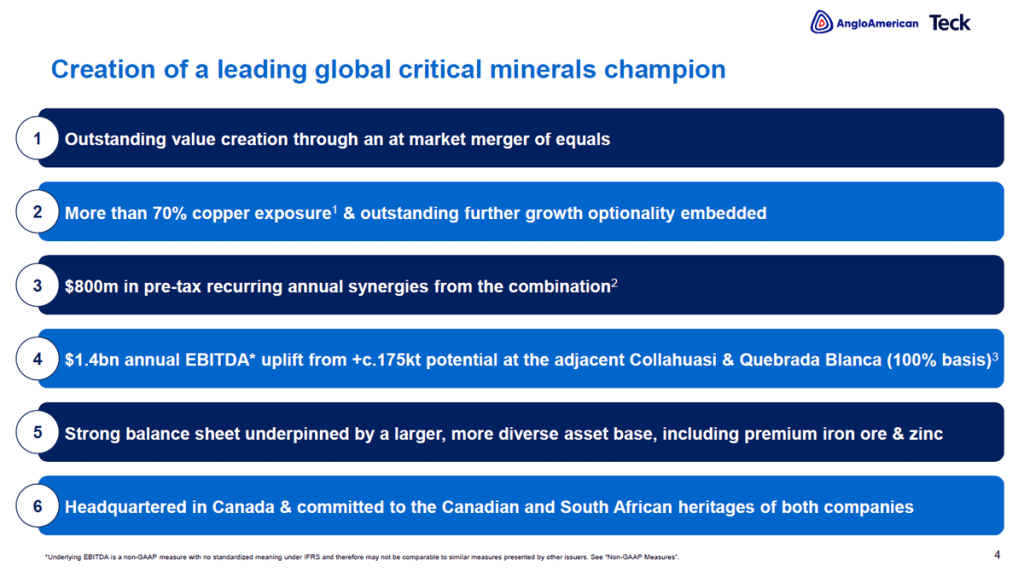

So here are some of the outcomes:

- ~70% copper exposure

- $800M in pre-tax recurring annual synergies

- A stronger leader, with more production coming from South America

But the piece de resistance?! This is it, in my opinion:

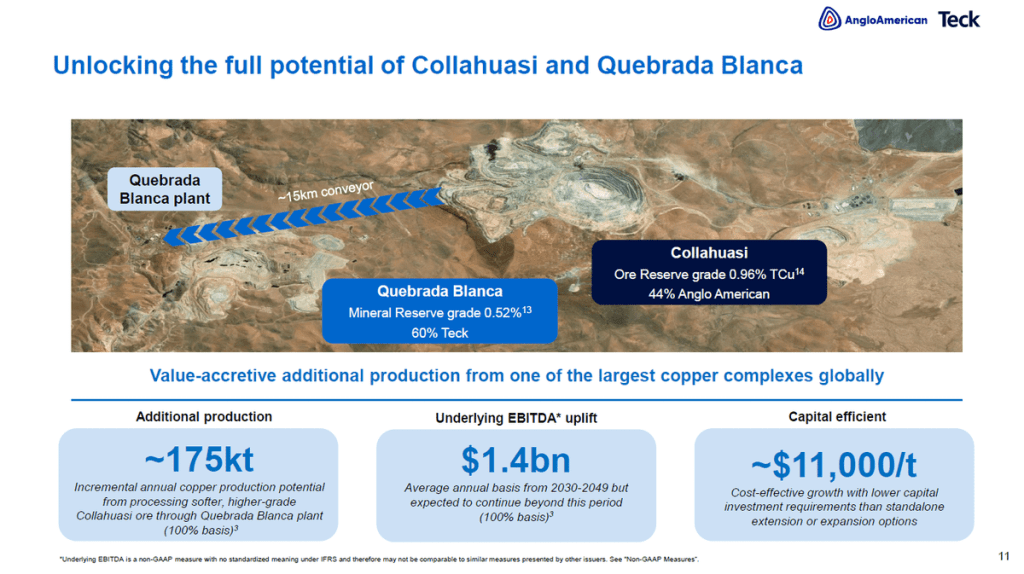

Joining forces to combine and unlock synergies (see what I did there? haha) between Quebrada Blanca and Collahuasi in Chile.

Costs would be significantly lower for the combined operation (and also for Los Bronces) and massive for the country that produces more copper than any other.

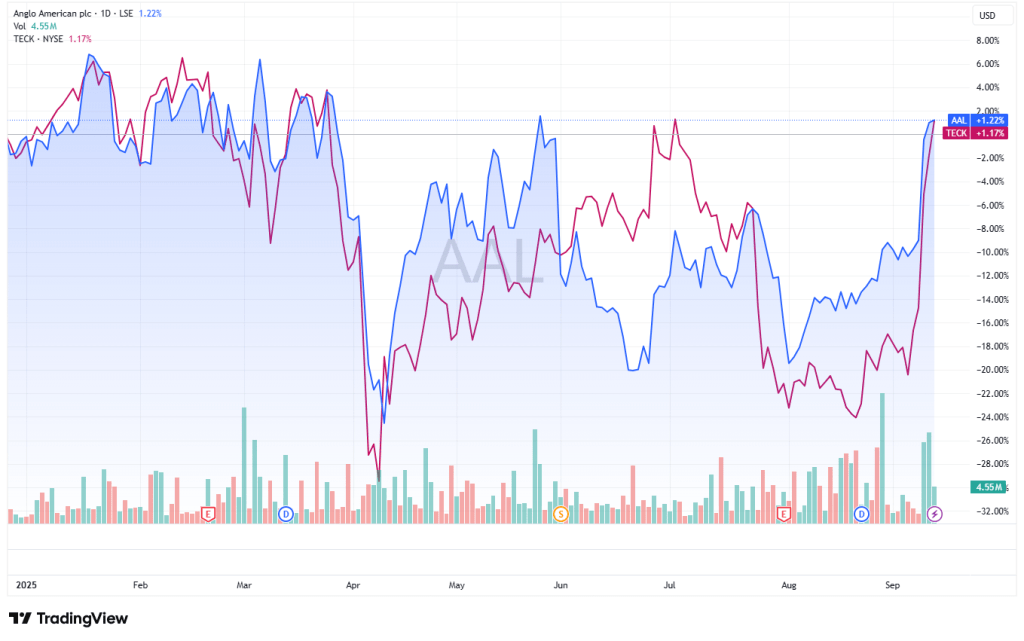

Meanwhile, both companies were up on the news.

$AAL up 12%, $TECK 24% over the last few days after the announcement, and there’s room for growth as they complete the combination.

I reckon they get Canadian approval with relative ease, due to HQ to be in Vancouver. We shall see!

And that’s it for today.

Where do you stand on this one? Would love to know.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Presentations for both companies, merger announcement and presentation, on their respective websites.