Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

For a while now, loud voices have been uber focused on the slower-than-expected EV growth to support an extremely bearish view on lithium. Many are now singing another tune.

As AI came out of the blue to underpin copper, now lithium demand has a new driver.

In fact, lithium sentiment is turning around amid increased BESS demand and continued (albeit slower) EV growth.

BESS or Battery Energy Storage Systems (such as $TSLA Megapack and Megablock) are forcing an inflection point, because installations are growing faster than expected.

Prices are, in fact, on track to recover by 2026, with a deficit expected for 2027/8.

We have been saying the outlook is improving for a bit, but what’s exciting now is that large institutions are seeing improvement coming to the market.

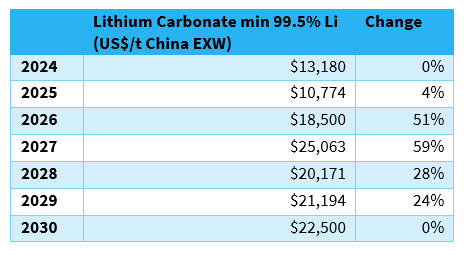

Canaccord finally updated its price deck. They see prices improving strongly in 2026-7, as shown in chart below. Spodumene gets even higher bumps, $1,600 for 2026 and $2,250 for 2027. Earlier this year, they called recent lows as the bottom and, given that new capacity was being delayed or cancelled, said they remained constructive on pricing.

UBS, on a recent note, went even further. Analyst Levi Spry said that BESS will lead a new upcycle, prompting a major reset of both price forecasts and earnings expectations. They lifted their lithium demand outlook by 11% through to 2030, with BESS demand accounting for 30% of global battery demand (from 20% today). They now see the market moving into deficit from 2026. They had previously pointed to a tighter supply reality by the end of 2025 and 2026, but now clearer data supports bolder expectations.

But there’s likely one extra kicker here.

Let’s put a pin on it for a sec and talk about what we’re paying attention to this week:

Macro

- Silver and copper are taking the place of gold as the ‘hot‘ metal trade moving into 2026: For silver, after nearly doubling this year, it has outpaced gold with strong signs of endurance, with Chinese inventories at decade lows. For copper, trading houses have started to ship more metal as Trump’s expressed plans to revisit tariffs in 2026. More broadly, industrial uses for both metals remain on the rise.

- Economic calendar: US expected to cut rates; auto production from Brazil (1.8% previous); industrial production UK (-2% previous); Australia RBA expected to hold rates; China inflation. Copper output from Chile fell 7%, after dropping 4.5% the previous month.

- Regulatory: The Trump administration is working with Argentina, Ecuador on a broad trade deal that includes collaboration on critical minerals.

Meanwhile…

These companies are making bold moves.

Deals, capital raising and IPOs

- Glencore $GLEN to restart its copper mine in Argentina by 2028, on strong prices and regulatory stability

- Rio $RIO wants to divest from low-value commodities

*If you’re viewing this via email, click on the date to view the full tweet and any available sources.

- Unity Metals Limited $UM1 is preparing for a listing on ASX via an A$10M raise; their focus is on gold and copper in South East Asia. Canaccord Genuity (Aus) is the Lead Manager, Bacchus Capital Advisers (UK), and JS First (Malaysia) are Co-Managers, and the price on listing will be A$0.20/share.

- Outcrop Silver $OCG graduates to TSX from TSX-V and Andina Copper (formerly Pampa Metals) commenced trading on TSX-V, delisting from CSE.

Typically, we expect a lift in targets and weakness in acquirers, and often, peers to targets get extra love. For IPOs, we keep an eye on listing day/week, as big swings may point to opportunities.

News, rating updates and research reports

- Fury Gold Mines Limited $FURY Price Target Maintained at $1.40/Share >> read

- Lithium Americas Corp. $LAC Raised to Hold From Sell, Price Target Is Maintained at C$6.50/Share >> read

- Pan American Silver Corp. $PAAS Maintained at Buy, target raised $51.00/Share From $46.00 >> read

- ST GEORGE MINING LIMITED $SGQ reports thickest intercept to date at Araxa, 115.65m @ 3.34% TREO and 0.34% Nb₂O₅ from surface >> read

- OceanaGold $OGC could shock everyone in 2026 >> watch our review

For more, join +40K and follow us on socials

Upcoming, discussions and deal flow

- Canadian gold explorer focused on Mexico and Peru.

- New assets and technologies for acquisition and investment. See some examples in our deal flow view.

Now, back to lithium: UBS sees a lot of upside coming to ASX-listed players like PLS, and also to brine-heavy producers like Albemarle.

In addition, I reckon we’ll see more spillover from rare earth strategies, e.g. Western supply further prioritised and even get preferred pricing, and/or governmental support. For example: $LAC soared on a deal with the US, and despite a pullback, it doubled in value since Jan to $2B.

The tide is turning.

Where do you stand on this one?

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

Extra resources

Latest thread

Latest posts

What I’m reading

- Material World by Ed Conway. Highly recommended, for both newbies and experienced investors and truly anyone wanting to understand our world more deeply. It comes packed with fascinating historical perspectives and colourful anecdotes. It will change how you think about materials forever.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

Sources: Canaccord research, Bloomberg, Reuters, Mining.com, TradingView, ASX, TMX, NASDAQ, LSE and SRC research. Figures shown in US dollars unless clarified.