In fact, the largest mining companies believe copper is set for a fascinating ride. Recently, they shared outlooks at the Deutsche Bank annual copper CEO conference. Here are your key takeaways:

On the bullish side, disruption is expected to be substantial due to the Grasberg incident in Indonesia.

The mine is 3-3.5% of global copper mine supply and it will remain out of action for an extended period, after the mud rush at the start of September.

No bueno.

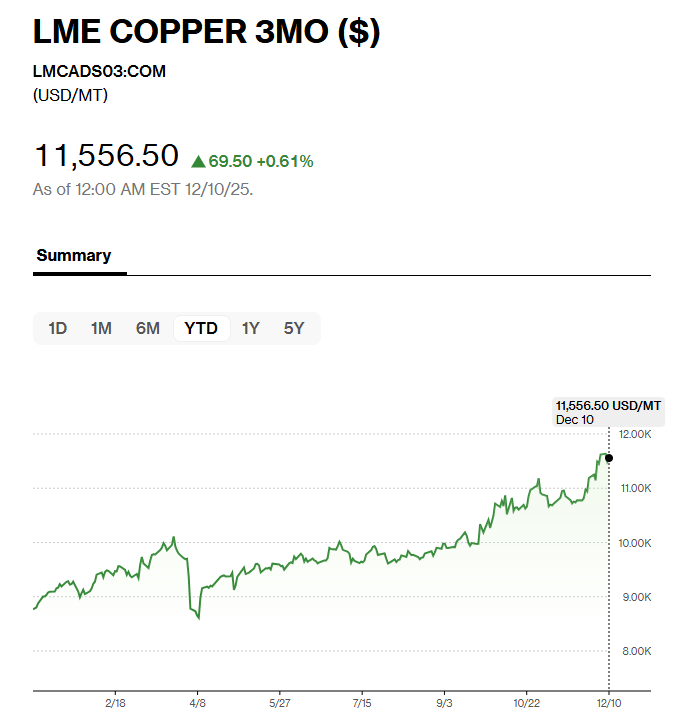

Furthermore, Freeport announced material downgrades in Q4 and 2026, up to 500kt in total. $FCX shares plummeted 20% in 2 days (shedding about $10 billion) and slingshot copper past $10,300. Since then, Freeport has recovered and copper is now well beyond $11,000/tn.

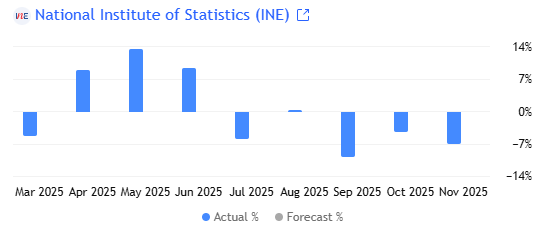

This comes on top of issues at $IVN Kamoa Kakula and Codelco’s El Teniente, and Chilean output falling for most of the past 9 months.

The experts flagged a ‘very tight’ concentrate market, plus given recent disruptions we’ll likely see mine supply growth turning negative on Q4, which means an even tighter market and vulnerability to further disruptions.

The top 16 miners group will see a drop of 3% for the year, with most coming this quarter.

Those present, including $FCX $BHP $LUN $RIO reported being unanimously bullish on the outlook for copper for the medium term.

Electrification remains a key demand driver, with underinvestment, high capital costs and long lead times as constraints inherent to the supply side.

Furthermore, CAPEX intensity (i.e. project budget divided by annual copper production) has 2x from 2018-9, reaching $30-40,000/t and is seen as structural.

Deutsche maintains its previous analysis, suggesting incentive prices must be ~$10,000/t+ to foster investment. So far, so good.

Permitting remains an unsolved -and long-standing- problem, and the main bottleneck.

Unsurprisingly, companies want to balance strong standards with simpler, more predictable processes. Amen to that…

But not all is roses.

On the bearish side, presenters said prices are ‘a little ahead of fundamentals’ (happening a lot these days, huh?).

Chinese demand is seen as slowing in H2 vs strong growth in H1 and before Grasberg.

Alas, the refined market is in clear surplus. Yet…

It’s heavily dislocated regionally: ex-US stocks are down, while US stocks are soaring YTD.

Given that the risk of tariffs on refined copper imports is still there, local inventories are unlikely to flow out any time soon.

This means mine supply will be the key constraint in 2026/7.

Foreign investment laws in Canada have tightened substantially, review periods for big deals are longer and extremely challenging.

Foreign investors must demonstrate a ‘net benefit’ to Canada.

The $AAL $TECK merger (which was just approved by shareholders) is seen as a ‘credible corporate structure and set of commitments’ and expected to raise the bar for future strategic buyers eyeing Canadian assets.

The recently enacted RIGI bill in Argentina offers substantial benefits to major mining projects and is seen as promising for a boom in investments in coming years… if political fluctuations can be managed.

Provides tax breaks, favourable forex regulations and fiscal stability.

Lundin, BHP, First Quantum, Rio Tinto and Glencore $GLEN are progressing projects, expect full sanctioning decisions in 2026-8.

Infrastructure requirements for these big projects needs further clarity, especially given the often remote locations like the Andes.

Side note: in case you’re shocked this is in the note, I promise I’m not cherry picking. I was shocked too but need I remind you that Argentina and Chile share a +5,000km border by the Andes? Argentina will become a leading copper producer. When? The billion lb question! $MUX is our favourite call.

Overall, the outlook is markedly bright. Bring on 2026!

That’s it for today.

What’s your view on this? Would love to hear.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.