The signs are piling on that the lithium market (~$16 billion in value) is turning a corner.

First, in August, Jianxiawo, a Chinese lithium mine owned by CATL, was halted due to a permit expiry. After months of back and forth (and billions lost and gained across stocks, fueling volatility) the mine remains closed, ~6% of global production.

Then, lithium prices are reacting as demand is finally starting to recover.

But probably not only from where you’d think…

It’s all about BESS (Battery Energy Storage Systems), such as $TSLA Megapack and Megablock as installations are growing much faster than expected.

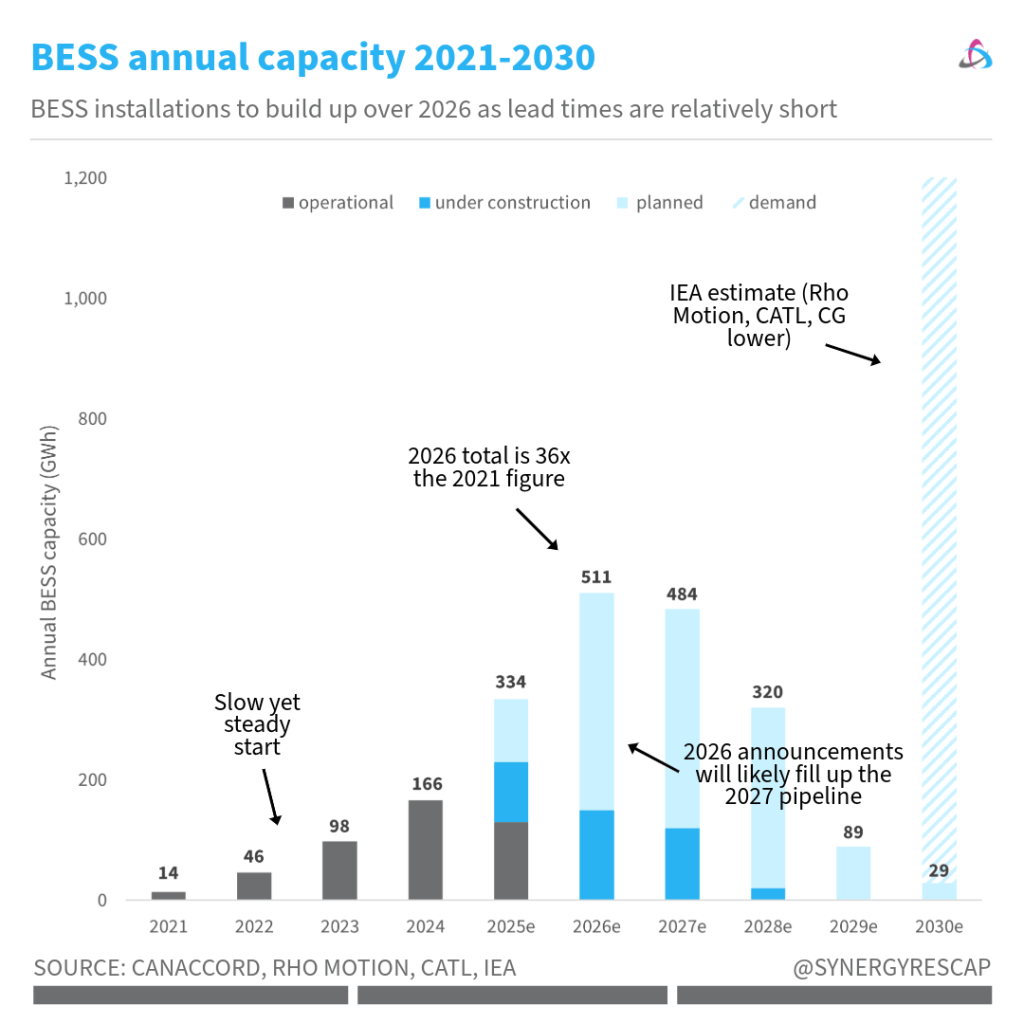

Sustained growth continues, with a new record projected for 2026, as per the chart below.

This projection looks a bit cautious, you may think.

But BESS installations have relatively short lead times (6-18 months, depending on scale).

Therefore, Canaccord expects 2027 capacity announcements to build up over 2026 and lift further the totals much higher.

In fact, the IEA forecasts 1,200GWh in capacity by 2030.

Canaccord, in turn, sees just shy of 800GWh and a cumulative ~8TWh by 2035. They see BESS taking up 23% of total LCE demand over the next ten years (up from 18%).

BESS are set to play a star role.

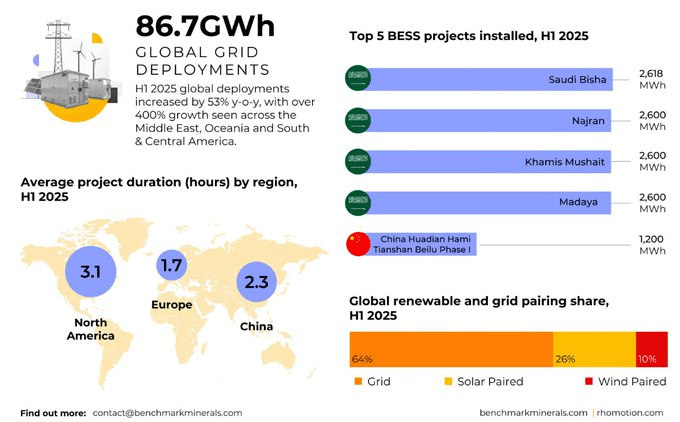

BESS projects are on the rise, further fueling lithium forecasts. Global deployments increased 53% YOY in the first semester with massive growth across Asia and South/Central America. This is just getting started…

Why is this happening?

LiB pack costs have fallen by ~75% since 2015, 43% since 2022.

Main reasons for this:

- Cheaper battery raw materials

- Gigafactories created economies of scale

- Innovation, cost cutting across Chinese players

- Shift to cheaper LFP batteries, ~15% for BESS in 2021, +80% now! (bad for nickel as NMC lost ground)

Insane expansion.

Going forward, this brings 3 strong drivers for BESS:

- firming of new solar and wind capacity

- optimisation/stabilisation of the grid on a systemic basis

- UPS back up for data centres currently fuelling the AI boom led by $NVDA

And it makes sense.

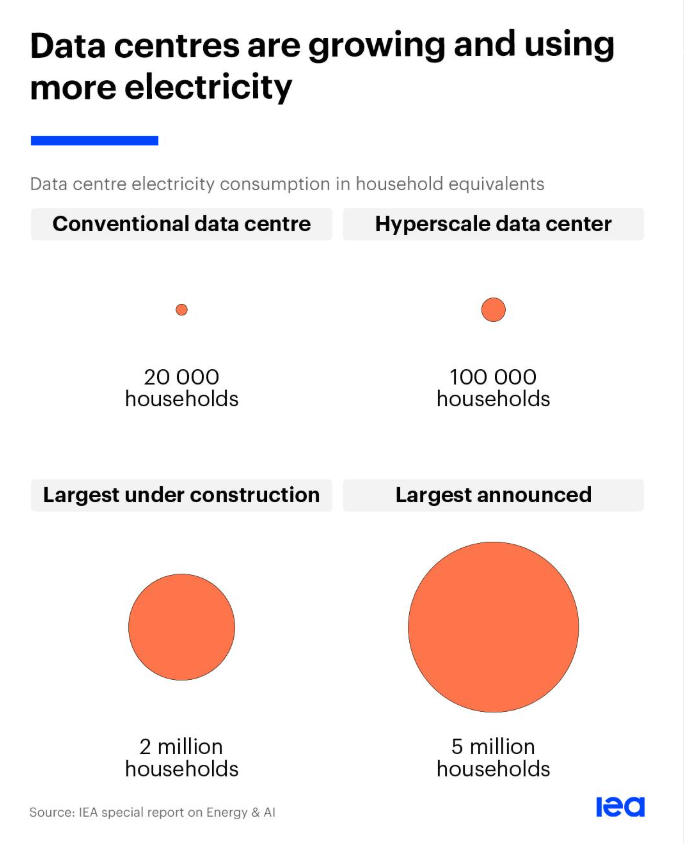

Electricity demand from data centres is expected to balloon, reaching as much as 5% of total power demand by 2035.

And these centers can use the same amount of energy as thousands and even millions of households.

What about EVs? Still growing… just a tad slower. 26% YoY (YTD).

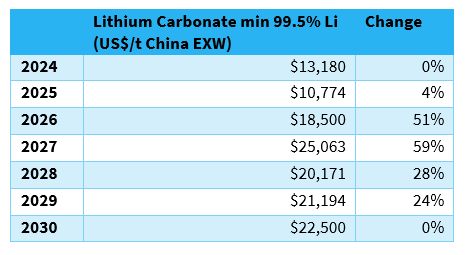

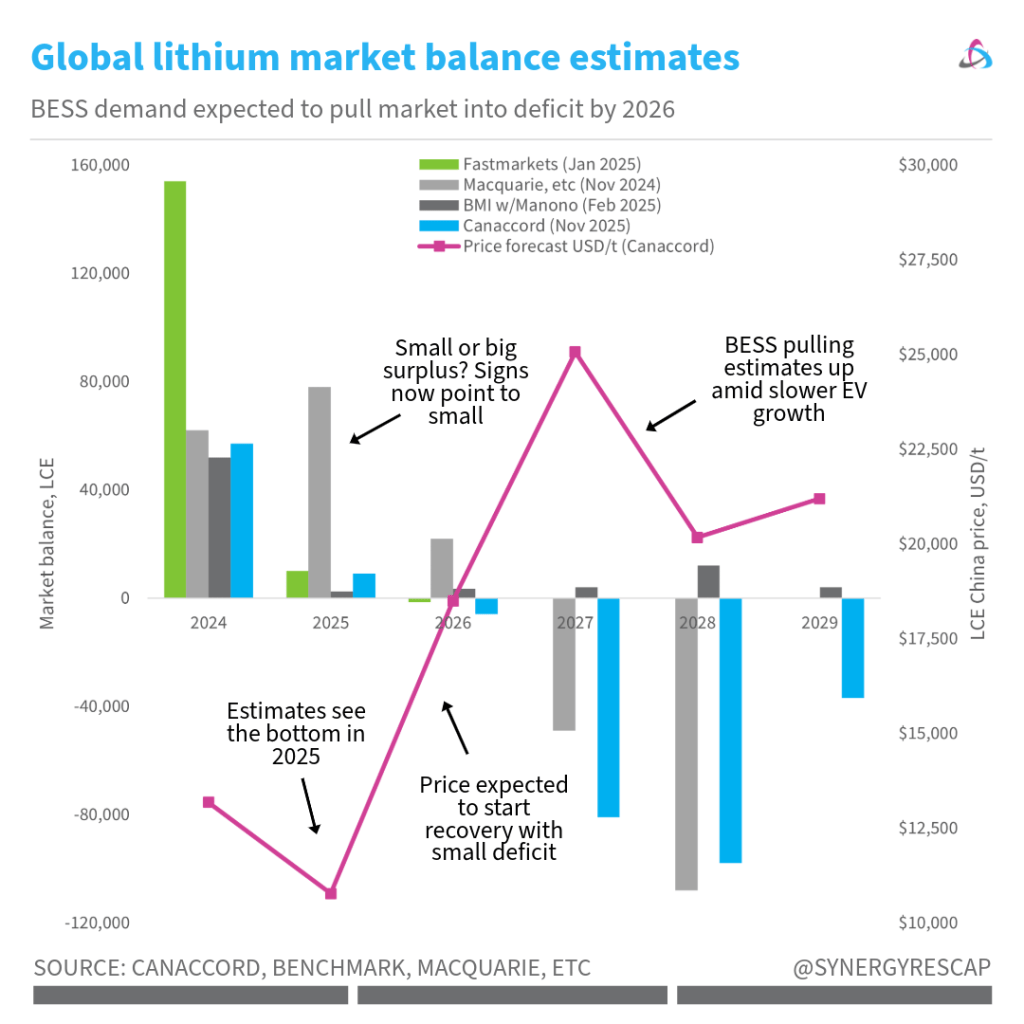

In sync, Canaccord finally updated their price deck. They see prices improving strongly in 2026-7 (spodumene gets even higher bumps, $1,600 for 2026 and $2,250 for 2027). Similarly, JP Morgan sees $18,000 for LCE and $2,000 for spodumene, for next year.

To summarise…

Putting all of this in one chart, here’s what we see:

- Ending 2025 relatively balanced SxD

- Price recovery continues through 2027

- Shift to small deficit in 2026, deepening in 2027-8

And here’s a possible side benefit:

I reckon we’ll see more spillover from rare earth strategies, e.g. Western supply further prioritised and even get preferred pricing, and/or governmental support.

We already saw a tease with $LAC as they soared on deal with the US and despite a pullback, it doubled in value since Jan to $2 billion.

And that’s it for today.

Overall, estimates now point to BESS picking up the slack from slower EV growth, as data centres pop up across the world. And that’s beautiful to me (and all lithium investors).

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.