There is no decarbonisation without copper, and we’ve been underinvesting for over a decade. However, there are projects in the pipeline, if we can get past roadblocks…

Here’s your list of 10 deposits that could ignite the #energytransition, and bring over 200b lbs in supply

1 🇺🇸 Pebble $NDM.TO

Located in Alaska, and potentially a boon for US-based electrification efforts, this mammoth has faced strong community opposition due to environmental concerns & NIMBY.

Uncertain if it will ever be built

56b lbs 💎 0.40%*

2 🇺🇸 Resolution Copper $RIO $BHP

In Arizona, a JV between Rio Tinto & BHP. Discovered over 2 decades ago, $2b spent, expected to be producing by now. Faces opposition from aboriginal communities. Permitting process can get long & painful…

40b lbs 💎 1.5%

3 🇦🇷 Pachon $GLEN.L

Located in San Juan, Argentina also in the high Andes. Owned by conglomerate @Glencore . Discovered in the 60s, currently working on feasibility. Glacier concerns and the country’s financial woes have slowed it down

33b lbs 💎 0.47%*

4 🇪🇨 Alpala/Cascabel $SOLG.L

SolGold & Cornerstone own this asset, working in Ecuador for over a decade. The country has been challenging, but they’ve expanded the resource, completed pre-feasibility & received support from $OR.

21b lbs 💎 0.37%*

5 🇦🇷 Los Azules $MUX

In San Juan, Argentina, high Andes. $2.4b CAPEX, infrastructure & jurisdictional challenges, but @McEwenMining keeps relentlessly expanding and doing pre-development work

10b lbs 💎 0.48% | 19b lbs 💎 0.33%**

6 🇦🇷 Taca Taca $FM.TO

In Salta, Argentina. BHP (Dad 🖐 again!), then Lumina Copper, acquired by First Quantum for $470m. Reserves declared in 2020 and moving along. Mining-friendly province w/lithium developments. $NOVR has a royalty

15.5b lbs 💎 0.44%

7 🇦🇷 MARA (fmr Agua Rica) $YRI.TO

Formerly BHP (Dad managed it in the 90s), currently Yamana -getting acquired by Gold Fields-, Glencore & Newmont. Community issues, NIMBY but aiming to use infrastructure at nearby Alumbrera (fmr mine)

11.7b lbs 💎 0.48%

8 🇦🇷 Altar $ALDE

Located in San Juan, Argentina, high Andes. Previously Peregrine, Stillwater-Sibanye, currently @AldebaranInc . No economic studies yet, but resources continue to be expanded. Similar challenges as Azules & Pachon

11.3b lbs 💎 0.43%*

9 🇦🇷 Jose Maria $LUN.TO

Yet another deposit in the Andes. Formerly Jose Maria Resources, acquired by Lundin last year for C$625m. With Filo, part of a newer wave in copper discoveries in the region, linked to @LundinGroup

6.7b lbs 💎 0.30%

10 🇨🇱 Filo del Sol $FIL.TO

In Copiapo, Chile straddling the border with Argentina. As with all high Andes, seasons are limited due to weather. In recent years, Chile has become harder -community opposition, political swings- but the markets love Filo… and copper ❤ Chile!

2.2b lbs 💎 0.39%

What a list! Been to a few myself.

Will all these copper deposits get developed? Hard to say. Some will, definitely. But in general, it’s taking way too long. We must fix this to fast-track the #energytransition.

Want more? Here’s another great list

References:

- All figures in billion lbs

- 💎 Grades are Cu not CuEq

- Cu= copper

- CuEq= copper equivalent

- *= measured + indicated resources

- **= 1st indicated, 2nd inferred

- No clarification = reserves

Confused about reserves vs resources? See this.

Notes:

- Copper is found w/other metals, and those mentioned contain gold, silver, molybdenum, etc. Not included to focus on copper

- Multiple sources were used in the compilation. See companies’ websites for more details (or ask for the links & I’ll add at the end of the thread)

- There are more undeveloped deposits elsewhere in the world, equally relevant. My focus is on the Americas & Australia, hence my lists will always skew that way.

- From this group we only hold $MUX

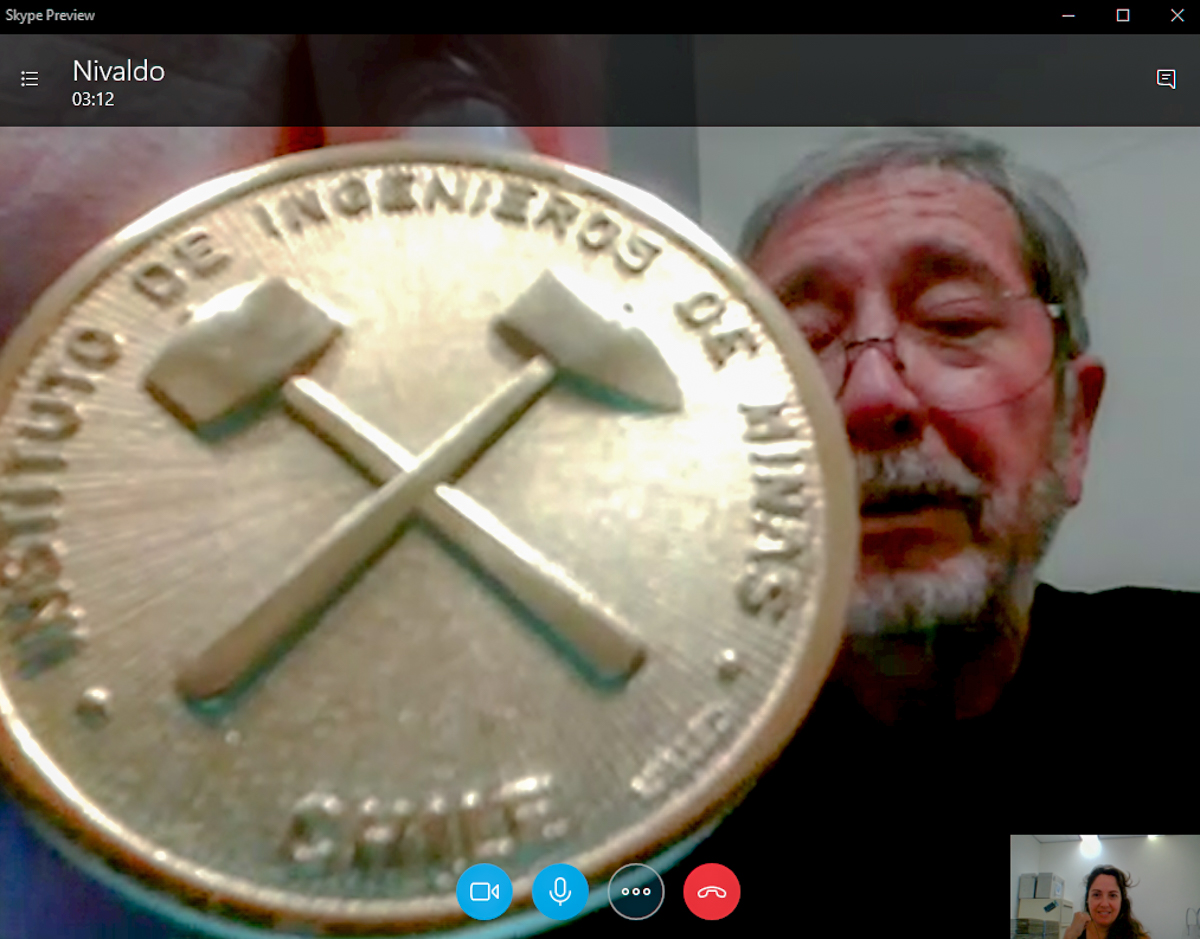

- Nivaldo Rojas, FAusIMM @IIMCh Dad was a copper porphyry expert/geologist focused on the Andes. He visited hundreds of copper deposits globally in his 50-year career. From this list, he explored Los Azules, MARA, Taca Taca, Pachon & Altar. He passed away in 2017 💔

TL;DR

- Copper deposits are large & expensive

- Take decades from exploration to mining

- Permitting is a nightmare

- Lots of NIMBY & community opposition

- The Andes is literally a ‘gold mine’ (well, copper-gold 😁)

- High altitude can slow progress

- 10 gems= over 200b lbs metal

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.