We live in a mineral-intensive world, yet many investors are on the fence about the sector.

If that’s you, here are 5 reasons why you NEED exposure to mining and metals.

There are many reasons but… I will give you my top 5.

Hey hey! I’m Paola Rojas. I’ve been investing for 17 years, and as a corporate advisor to miners and investors have worked on over $80m in deals. Most of my work has been focused on the metals and minerals used in the energy transition. But I digress. Let’s keep going!

Yes, I’m a convert, and copper ‘runs through my veins’ after 5 generations, but I strongly believe every investor should have metals in some shape or form, to future-proof their portfolio.

1) Upside

How likely are you to get the chance to invest in the next $META or $GOOG before they blow up?

Not very.

But you CAN invest in early-stage explorers that might turn a small investment into a ‘multi-bagger’.

Why? A discovery often lifts a stock 20x or more.

2) Diversification

The mining industry has cycles that are NORMALLY not highly correlated with other sectors of the economy.

So when financials/consumer discretionary/etc are imploding there’s a good chance miners are holding steadier.

3) Passive income plus some capital gains

Investing in producing companies can give you both passive income for your portfolio (and there are many companies with a stellar dividend yield, like $RIO or $BHP these days), along with some upside for the future.

While producers are not expected to grow dramatically, there’s always the chance of extra gains that will flow through to shareholders, such as when they:

- find a satellite deposit or

- spin out a non-core asset into a newco

- sell an asset for stock or cash consideration

4) Gold is still a good hedge

When chaos is among us, more often than not, $gold will remain STRONG (or at least stronger than other asset classes), as many investors ‘fly to safety’, driving prices upwards.

And gold must be dug out of the ground to find its way into bullion…

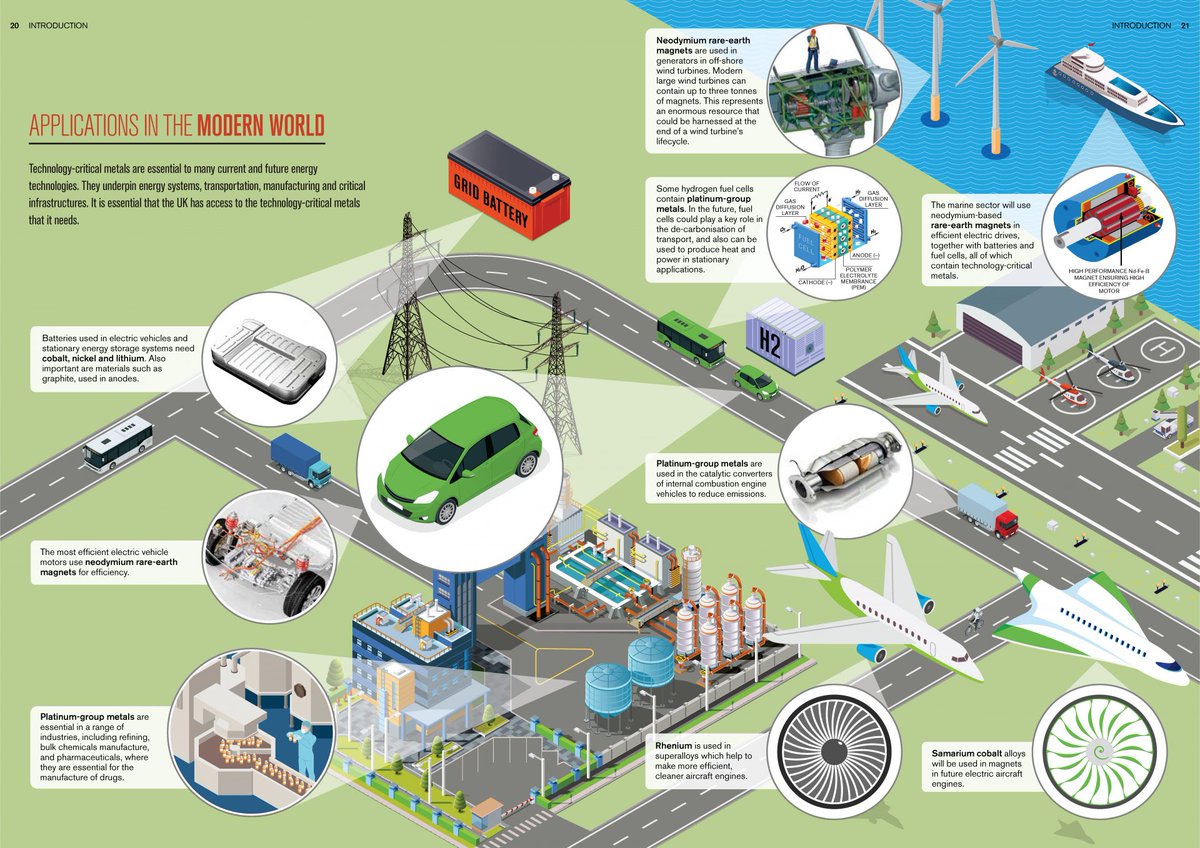

5) Current technology loves metals

The devices we use today merely glimpse what we’ll have in 10, 20, or 100 years.

Can you even imagine?

By then we’ll surely have alternatives and new materials (think nano), especially a century from now.

But if you are alive today, our tech relies heavily on lithium, copper, gold, silver, cobalt, nickel, and graphite, to name just a few metals in batteries, electronics, cables, etc.

And to get them must be mined (and be recycled whenever possible).

Investing in metals makes good sense for civilisation AND your portfolio.

Keen to learn more? You can start right here.

These are some insightful accounts:

@RickRuleRulz

@TraderPamplona

@TheLastDegree

@TaviCosta

You may also like my Toolkit.

And that’s it for today!

Summary

5 reasons to invest in mining and metals and future-proof your portfolio

- Upside

- Diversification

- Passive income

- Gold is a good hedge

- Current technology loves metals

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.