Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

In my early teens, my dad was the country manager for BHP in Argentina. We lived in Salta, a beautiful city in the north of the country. One summer, we decided to spend our holidays in Andalgala, a tiny town in the province of Catamarca. It was the closest to their Agua Rica copper project so the company had chosen it to be the project base. It was one of those places where life happens in slow motion, with the quiet comfort of daily siestas. A new copper mine, Alumbrera, was being built nearby.

It worked. In the evening we’d leisurely walk to the central square where everything happens (as in most Spanish-influenced cities) for dinner and ice cream. We’d run into some of the ‘power brokers’ of the town; they all knew him and stopped to say hello and chat for a bit. As a kid, I felt super proud to see that.

Dad was well-liked. He was a kind man, and his approach to both employees and community relations was pretty simple: treat everyone with respect, appreciation and honesty.

Back then the project was well-defined and most expected it would progress quickly. Dad even won an internal award for his role.

The challenge

Despite having better technology and extraction methods, mining is becoming more challenging than in the past. Certainly harder than it was while I was growing up and heard about all the mines and projects Dad and his colleagues visited.

‘We’re sitting on a cliff with most existing copper mines suffering from declining grade and production while discovering and developing new mines is getting ever more difficult due to socio-environmental concerns and a lack of investment in exploration to find the next generation of long-life deposits.’

-Robert Friedland, Billionaire and CEO Ivanhoe Capital Corporation

Due to their massive scale, copper deposits are some of the most difficult to finance and build. So Agua Rica had some tough odds to beat.

Welcome to our newsletter with insights on metals, mining and energy transition investing.

The cruelty of copper prices

By the late 1990s, BHP had spun out Agua Rica into a separate entity. Dad remained focused on exploration more generally so he handed over the advanced project to another team that would progress it further. So we never went back, and some of his team members took on roles in the new entity, Minera Agua Rica. It all seemed to go well, from afar.

But then, markets turned. The copper price had plummeted making their $3.2 billion acquisition of Magma Copper a disaster, and cuts went deep. They decided to shut down exploration in the country. Dad didn’t want to leave Argentina, so he closed an 18-year chapter of his life (and ours) and said goodbye to his beloved BHP.

By 2003 they had sold their stake in Agua Rica for a mere $12.6 million to their JV partner, Northern Orion.

Whimsical exploration budgets

Exploration is how we find the mines of tomorrow but it’s a pretty expensive and risky endeavour. Odds are less than 1 out of 100 projects will become a mine, and because most minerals and metals are commoditised, you can’t control prices, only your costs. So exploration ends up being a bit like marketing or advertising… when times are tough, it’s the first thing to get cut.

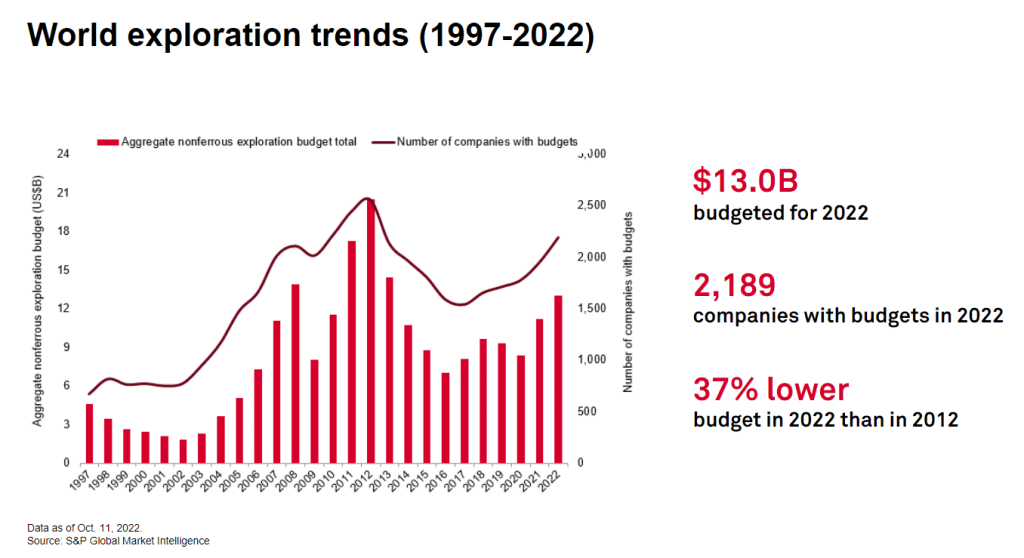

S&P Global diligently tracks budgets, and every year releases an in-depth study for everyone to access. The apex for both companies and in totals, was in 2012, and we’re way down these days.

Social license is fickle

You may think that these days we’re spending less because success rates have skyrocketed. Alas, that’s not the case: this decade, average discoveries have fallen to 1.5/year, from 10.4 previously. And rising costs and technical issues are indeed contributing but I reckon NIMBY is one of the most destructive.

Hidden among these are many projects like Agua Rica, discovered yet not in production due to severe social opposition. Back in that summer holiday, it couldn’t feel further away. But at some point, things turned sour. First, incensed by foreigners and some ‘porteños’ (people from the country’s capital, Buenos Aires) opposing the Alumbrera mine and then turned on Agua Rica.

These 10 projects have been working towards development yet none is a mine today. Some face serious community/social opposition, and others are just progressing along the long road of development.

- 🇺🇸 Pebble $NDM.TO

- 🇺🇸 Resolution Copper $RIO $BHP

- 🇺🇸 Twin Peaks $ANTO

- 🇦🇷 Pachon $GLEN.L

- 🇪🇨 Alpala/Cascabel $SOLG.L

- 🇦🇷 Los Azules $MUX

- 🇦🇷 Taca Taca $FM.TO

- 🇦🇷 Altar $ALDE

- 🇦🇷 Jose Maria $LUN.TO

- 🇦🇷 🇨🇱 Filo del Sol $FIL.TO

Agua Rica becomes MARA

Due to a combination of maladies including social opposition and Argentina’s woes, the project underwent a series of acquisitions (talk about a hot potato…). During that process, Yamana renamed the project MARA (which stands for Minera Agua Rica).

It’s now 2023 and this magnificent deposit is not yet a mine. At the same time, the Alumbrera mine is no longer producing as it ended its life (hence the synergistic opportunities much more limited).

After the last in the string of deals, MARA is now fully in the hands of Glencore, who according to my sources, wants to bet more on the country (and has a few cards in).

Patience, my dear

I’ve always been a bit impatient. Dad used to tell me I needed to take it easy!

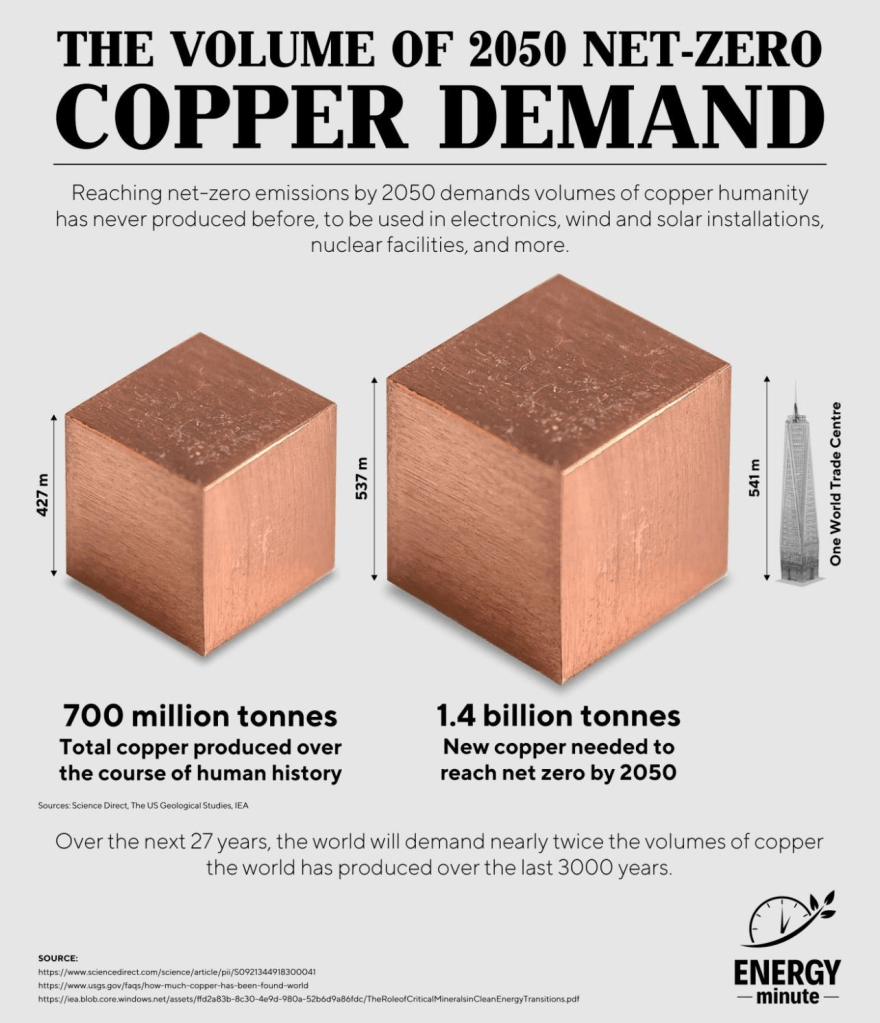

The reality is these challenges are not getting easier, but harder and patience alone will not cut it. BHP has said that we’ll need over 2x more copper over the next 30 years, compared to the previous 30, if we want to reach net zero targets. And here’s a brilliant visual representation of what’s ahead.

This is of course a simplification but it’s a good place to start thinking about the long-term opportunity (and challenge) we have in front of us. Understanding the mining lifecycle can help assess opportunities, and help time your investments.

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

A popular tweet from last month

Keeping track of what resonates is a great indication of investor sentiment. This one got a lot of attention!

In recent related news…

- Javier Milei is the new president of Argentina (as I expected!) – this will be good for investments in the country, although locals must endure painful months first

- The US plans to cut China’s access to IRA benefits

- Copper poised for a surprise in 2024

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.