When it comes to copper and the future, the challenges ahead for investors are quite clear to me.

This a topic I’ve spent years working on (a big portion with my father, a copper porphyry expert involved in the Escondida discovery) hence very dear to me, both personally and professionally. So I’ve thought A LOT about this.

On the one hand, you have an increasingly long initial exploration to production timeframe, thus taking more risk capital than in the past, as cash flow is pushed further forward.

And as we all know, the value of $1 today is not the same as in say, 2 years.

Accordingly, investment horizons will need to adjust if you want to play in the space.

This has proven tricky already with mismatches between such investments and private equity funds (typically seeking exits within 10 years) but also affects other types of investors.

And it will become even harder.

For instance, the clock continues to tick for assets held by Rio Tinto, BHP and Grupo Antofagasta Minerals, such as Resolution Copper and Twin Metals. Decades have already gone by.

The jury is still out (!) on whether many of these will ever see the light of day.

Some are listed in this post.

Secondly, given the long-term supply growth estimates, finding enough advanced explorers/developers who can ACTUALLY get to production will also be difficult given:

- jurisdictional risk,

- ever-growing social license issues,

- all on top of a myriad of technical challenges.

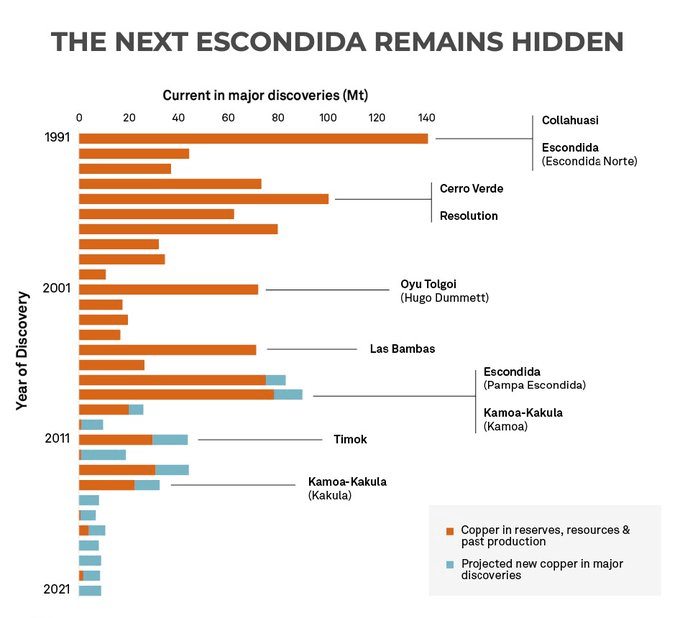

The copper landscape has painfully changed since the early 90s. Back then, dad was country manager, Argentina for $BHP. Copper was all they talked about. Now look at the last decade.

Placing ‘bets’, in such a situation, becomes an expensive game for meaningful allocations and implies extensive research and due diligence.

Larger institutions can adjust but from mid-size down to retail, it becomes a puzzle.

Sure, you can hold big players like those mentioned or Teck Resources Limited but you can’t rely solely on them; you need small caps too but… which ones? Not all are poised to succeed.

In addition, the depth of expertise needed to fully analyse these opportunities is not that common globally, as we operate in what is still a small sector. And competition for such talent may become fierce.

Overall, it’s looking like a tough nut to crack…

Of course, these are not the only challenges. But these should remain top of mind and are central, in my opinion.

And solutions need fundamental changes to the space… which will likely take some time.

I’ve written a lot about copper recently, You’ll find these posts here.

That’s it for today.

If you enjoyed this, please share it with peers. Every week I write about unlocking value in mining and the energy transition, mainly on X, LinkedIn and this blog.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.