Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

A few weeks ago BHP and Lundin Mining announced their joint takeover of Filo Corp. To stay in line, I thought it would be interesting to analyse a very similar opportunity, at the asset level.

NGEx is also part of the Lundin Group, its activities are focused on Argentina. They got some outstanding results recently. The Lundins have been operating there for a long time and have some great local operators (I knew some of them well before I moved to Australia!).

To frame it up, the world’s going to need probably about two times as much copper over the next 30 years, 34 times as much nickel, even two times as much steel to support the energy transition

-MIKE HENRY, CEO BHP

Any way we dice it, the world needs more copper and NGEx could realistically build a mine, as they are supported by successful groups.

Let’s get into it.

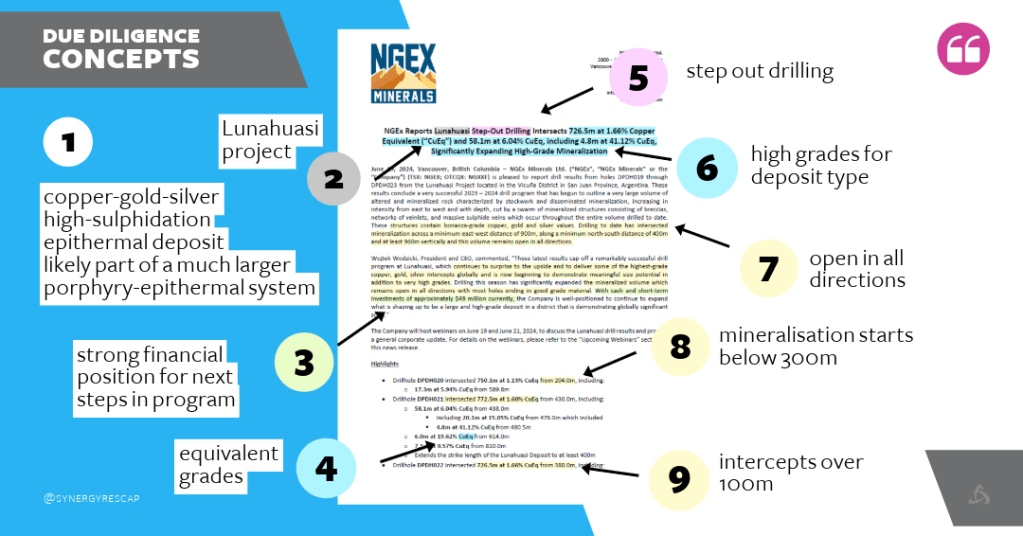

For this analysis, we’ll look at 9 tightly related concepts, analysing a recent news release. A brief background is provided as well as a preliminary opinion.

1) TYPE OF ASSET

In this case, they state on their website that it is: a ‘copper-gold-silver high-sulphidation epithermal deposit likely part of a much larger porphyry-epithermal system’. This is usually where we want to start, to reference back to what we know about this particular type.

Sometimes companies will not state this clearly in news releases. There are usually 3 reasons for this omission:

- The deposit is still being understood and while there may be indications of which deposit type it is (geologists need to start with a hypothesis), these may not be sufficient for the QP to state it clearly. In this case, you’ll find the uncertainty as ‘likely to be’, ‘similar to’ and the like (usually followed by mentioning a deposit with several characteristics in common).

- There may be at least a couple of deposit types within the same project. Very common, especially with porphyries.

- The company thinks investors won’t understand it and decides to keep it out. You’ll have to fish this info from their website and/or from technical reports.

✅ We love these types of projects. Let’s keep going.

2) NAME OF ASSET

The announcement covers the Lunahuasi project. This is just for proper housekeeping. Since companies usually have more than 1 project, we want to ensure we are not co-mingling results (unless the announcements are regarding targets within the same project).

✅ All good. Plus, this is a new project, so quite exciting.

Fun fact, the NG part of NGEx comes from ‘no guts, no glory’!

3) FINANCIAL SITUATION

We usually need to find out by accessing financials directly or via their latest investor presentation, but here NGEx is doing us investors a solid and telling us they have C$49 million. Thanks!

✅ They are well-funded (for real).

4) TYPE OF GRADES REPORTED

For this release, we get CuEq (copper equivalent grades, which combine copper and other metals). We don’t like to see these in the highlights that much, but we also get a detailed results sheet with gold and silver content and the formula they used to calculate these grades, including recovery.

✅ Nothing wrong here. There is one hole where a high CuEq contains 0.13 Cu, which is less than ideal but it’s an outlier.

5) DRILLING TYPE

This is a step-out program which implies they are still testing the area. So, anything can happen including a total dud. But here, only 1 hole didn’t return significant results. That’s a great outcome for such a program.

✅ Great results for this type of program. Stellar, actually.

6) GRADES

Highlighted grades are stunning. Of course, companies are supposed to put the best results front and center. Yet when you look at the hole-by-hole results, per metal, the view doesn’t change.

✅ Very high grades for the type of deposit. CHECK!

7) POTENTIAL SIZE

The announcement includes a very rough idea of the size of the deposit according to current knowledge and, as we love to see, indicates that remains open in all directions. This means holes ended in mineralisation. Lundin is likely targeting something of a similar size to Filo (6.7 billion lbs) and we believe there’s less risk in these midsize (yet still terribly appealing) projects.

✅ Promising scale.

8) DEPTH OF MINERALISATION

This is without a doubt a program with deep holes, especially if you ask an Australian geo (1 hole nearly reached 1,400m). This is quite typical in the environment where the project is located. Either way, we usually want to see mineralisation start below 300m and continue.

✅ Deep yet not too deep.

9) INTERCEPTS

In 2 cases, over 700m, and above 0.74 Cu (not CuEq, looking at the provided chart). Generally (and this can vary by deposit types) you want intercepts wider than 100m.

✅ Intercepts are outstanding.

CONCLUSION

After this preliminary review, the Lunahuasi project looks extremely promising getting 9/9 points, and grants further analysis. More generally, Argentina is a jurisdiction that in our view will start garnering more support, as long as the current government can continue its reforms and retain a pro-market attitude.

This is, of course, a simplification but it’s a good place to start. You can download the announcement in PDF below.

To dive deeper, understanding grades in depth would be the next step.

If you enjoyed this, please share it with a friend. The energy transition requires more savvy, committed investors and supporters joining in, to fully enable it.

That’s it for today.

- Germany launching a new $1.1 billion fund to invest in critical minerals and related supply chain

- CATL said to be suspending lithium production from a lepidolite mine in China

- Copper giant Codelco reported a production drop of 10%

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.