Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

This week in our newsletter:

- Trump vs mining

- Sentiment on socials

- Market update and outlook

- Opportunities in mining stocks

Trump is back in the White House. Whether you like it or not, whether you saw it coming ages ago or are dreading it… So let’s look into what this second term can mean for mining investing, mineral production in the country, its related applications and its potential impact globally.

Trump vs mining

Hard to believe it’s only been a couple of days and the executive orders have arrived FAST.

Here’s a section on ‘UNLEASHING AMERICAN ENERGY’, EXECUTIVE ORDER from January 20, 2025 (highlights mine):

I’m sure you are nodding now. It all sounds reasonable enough. But… is it?

Let’s take a look.

- Easier permitting

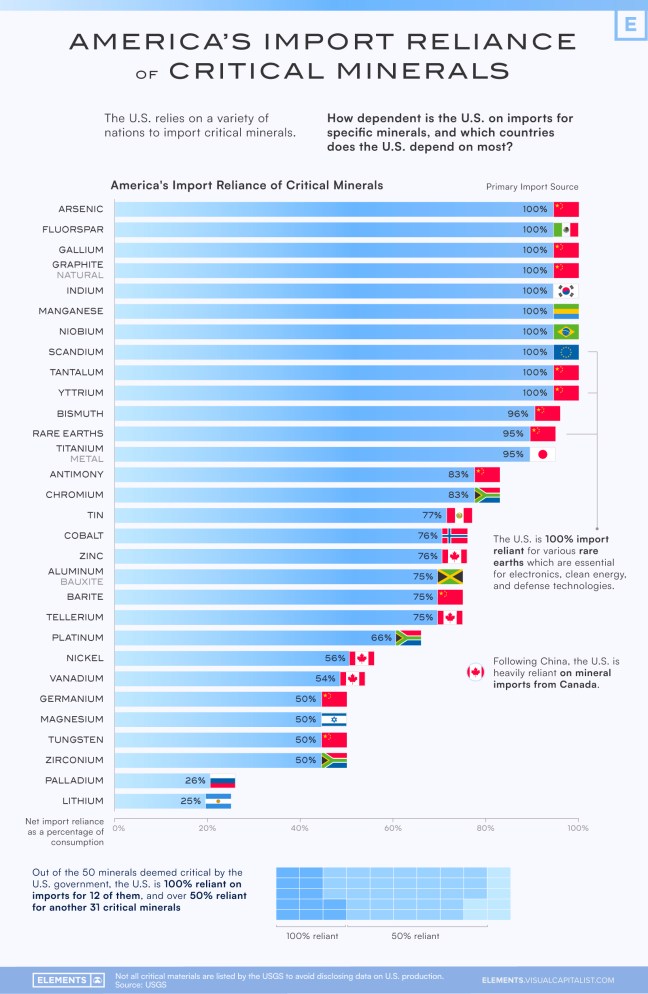

Despite a significant endowment, the US relies heavily on imported critical minerals. Gallium, graphite, yttrium, bismuth, and rare earths are at the top.

Over the years, layers upon layers of red tape, community opposition and NIMBY have emptied the pipeline.

Many projects await approvals, some for decades including copper elephants such as Resolution (owned by BHP and Rio) and Pebble Creek.

We should see progress overall.

- Strong support for uranium and nuclear

After the global sentiment turn for the positive, and the massive requirements for AI, nuclear energy fuelled by uranium looks poised for a firm push.

More reactors and incentives to miners coming.

I spoke a bit more about infrastructure in our last newsletter.

- More focus on domestic growth, less focus on ‘being green’

As an America-first proponent, we should see support for local production, perhaps tied with new restrictions with foreign ownership (hello Canada) or mandatory local ownership.

This may offset the removal of rebates, IRA and other Biden initiatives, instead of hurting the big picture.

Overall, despite where you sit in the political spectrum, mining seems likely to benefit from the next 4 years.

Sentiment on socials

A few days ago I asked how you view the year ahead, and it got plenty of votes. The majority is very clear about where they sit as 2025 gains steam.

If you are reading this via email, click the date to view the above tweet.

What do you think of the results?

This week in the markets

As a flurry of announcements comes from the new administration, gold is soaring even higher. Analysts and investors are expecting a bullish year for the precious metal.

Gold does love choppy seas.

Meanwhile…

In recent related news…

- Rio and Glencore were said to be in merger talks... but it was ‘old news’. Still, nothing is stopping them from opening discussions again. Let’s keep an eye as it would change the sector.

- Rare earth developer Arafura gets $200M to support new mine and processing facility.

- Fortuna divests a non-core mine in Mexico, NGEX expands its drill program at Lunahuasi, and Lithium Argentina completes its relocation to Switzerland.

- Plus Stargate is born ($500 billion for AI, with Arm, Microsoft, NVIDIA, Oracle, and OpenAI as the key initial technology partners while Musk says they don’t have the money!) and Saudi Arabia pledges $500 billion in investment to the US.

While complex geopolitics are here to stay, mining seems poised for a strong year.

Time for research

To start, these will help with a general perspective:

If you’re keen to jump on the deep end, here are some promising news & developments:

Definitely worth a deeper look to learn more. You can expand your research with these 10 questions.

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.