Read time:

Hey hey – another week is upon us, so let’s dig in. Metals, stocks, and above all, opportunities.

Accredited investor, corporate? Get deal alerts and more →

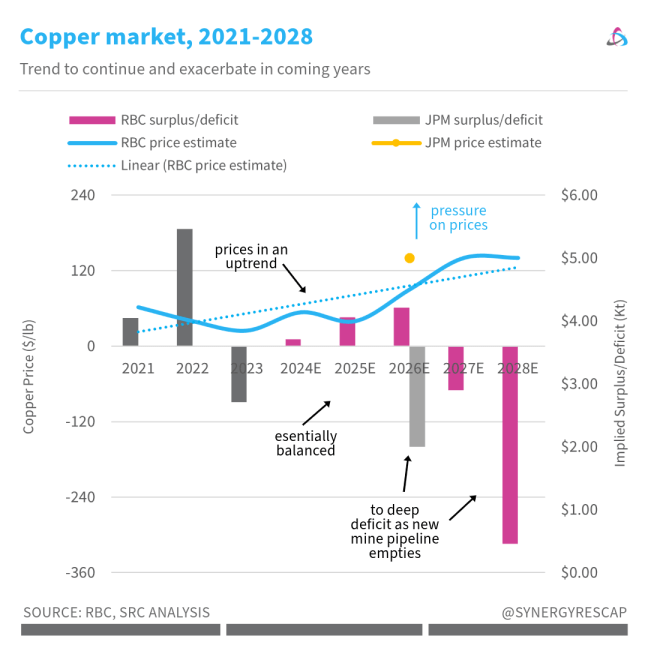

With copper at these healthy levels, let’s look at what the copper market may have in store for us over the next few years, in terms of balance and prices.

Let’s talk about this.

If we think about the copper market as a puzzle, and the different estimates from various banks and experts as individual puzzle pieces, sometimes it’s hard to find the corners, essential for an image to start surfacing.

Before doing my master’s in finance, I used to think analysts were these magical beings that could truly predict the future. Ha! Alas, all we can do is our best guess based on the data we have, and the models we use (with a sprinkle of intuition, I’d venture).

And then, an image starts to appear but remains kind of fuzzy and deeply prone to errors until… well until the calendar catches up with the estimate.

So, looking at the sources at my disposal, I chose some recent RBC and JPM analyses to dive deeper.

RBC sees 2 years of surplus before turning to deficit, with a stark figure for 2028. JPM data was available for 2026 where they see a big drop, in contrast with RBC’s surplus.

Improving demand and supply both keep a lid on prices, as per RBC, and their 2025-2026 price estimates $4 & $4.50/lb, respectively. JPM sees the price in 2026 at $5/lb.

This years’ movements have left these estimates somewhat short. But that’s not the biggest thing.

The wildcard here is Cobre Panama. A large mine in Panama, equivalent to a whopping 1.5% of global supply, shut down since 2023.

RBC modeled Cobre Panama to restart in 2026, w/350kt/year. It’s likely that the JPM figure does not factor in this.

While there have been some improvements in the relationship between First Quantum and the country, it remains highly uncertain when or even if, the mine will be allowed to reopen. Which should contribute to keep prices strong.

In the news

But of course, the plot thickens.

Because Trump has launched a battery of tariffs that are set to impact markets widely. Copper has immediately retraced, erasing wins over the last few days. We’ll have to see how countries start to adjust and what retaliatory measures they launch.

In lithium land, prices may still be depressed (although there may be a reprieve in the not-so-distant horizon) yet the deals kept coming. As Rio Tinto welcomed Arcadium as the merger is complete, now Orion, a big name in project finance, is now betting on more US-based lithium via a $250 million investment in Lithium Americas.

A final investment decision for Thacker Pass was announced this week, so I personally look forward to seeing the project finally get built and to seeing a recovery in the share price (plus we’re also looking at some comparables that could follow their path, coming exclusively for subscribers).

Signs of the bottom keep piling up for lithium. In a recent interview, Willem Middelkoop said he sees a recovery by the end of the year. I, in my humble opinion, agree.

I think this week will be hedged in market history as one of the most destructive, nearsighted and childish. But as long-term investors, we know this, too shall pass. It’s only 4 more years…

I’d rather end on a happy note, so let me close today with a meme. Copper, you are perfect!

Meanwhile…

ICYMI, these are now live on this blog:

- These minerals are STRATEGIC for artificial intelligence

- These Metals Will Soar in 2025

- Here’s how I start researching a new mining stock, 7-step process to find high-quality undervalued mining stocks and 5 times to buy that mining stock in your watchlist (and when not to) (subscriber-only)

- Featured:

That’s a lot! Subscribers can also access our weekly top mover alerts with 3 stocks that reported stunning drill results, are rising rapidly or had substantial insider action, all pointing to potential opportunity for investors:

And that’s it for today.

PS: You’ll find extra resources below. Become a member to access 80+ exclusive posts.

If you enjoyed this…

- Invest more confidently with Mining Investing 101

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.

I have potentially the largest Copper claim in the US for sale! Here in the US. Know any buyers? Guaranteed to be unbelievable! Miles of high grade.. Lmk, Pat Grimm 406-600-2199

Sent from Proton Mail Android

LikeLike