Lithium is widely found on earth, but to date, the market is still learning to grow and many challenges lie ahead.

Rising prices

Lithium and other battery metals and minerals are the bottleneck we must solve for the energy transition to go global.

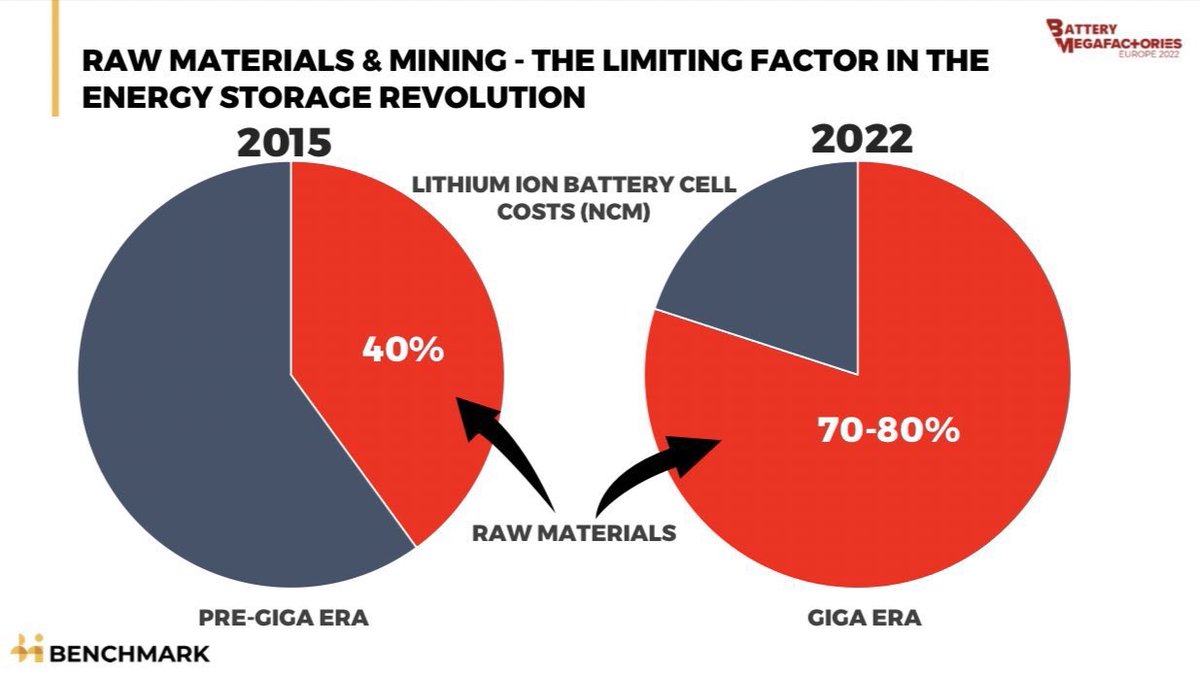

Before gigafactories existed, the raw materials in batteries represented only 40% of costs.

Fast forward to today, these costs have pretty much doubled.

📊 Benchmark Mineral Intelligence

Concentration

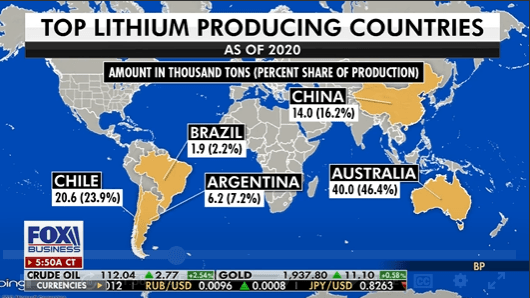

Supply is highly concentrated in a handful of countries, and a variety of sources.

📊 FOX Business

Lofty projections

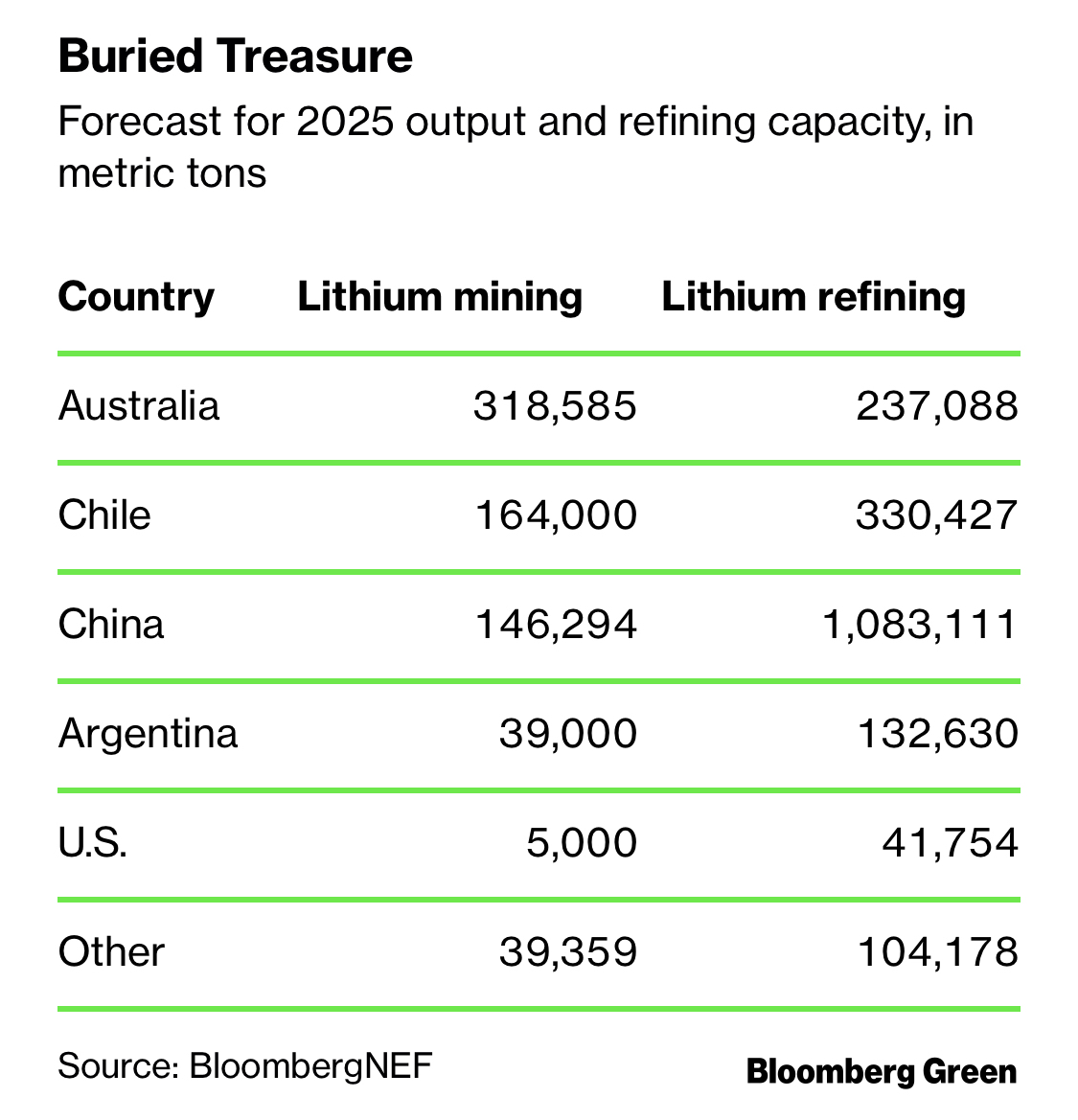

Bloomberg forecasted massive growth in both lithium mining & refining capacity for 2025, especially in China. Compare these figures with total production in 2020 (82,500 metric tons*) and 2021 (100,000 metric tons*), as noted by the USGS earlier this year, which converted into lithium carbonate equivalent equals 439kt and 532kt.

*metric tons of contained lithium, not LCE

📊 BloombergNEF (units in LCE)

Pipeline looks healthy yet…

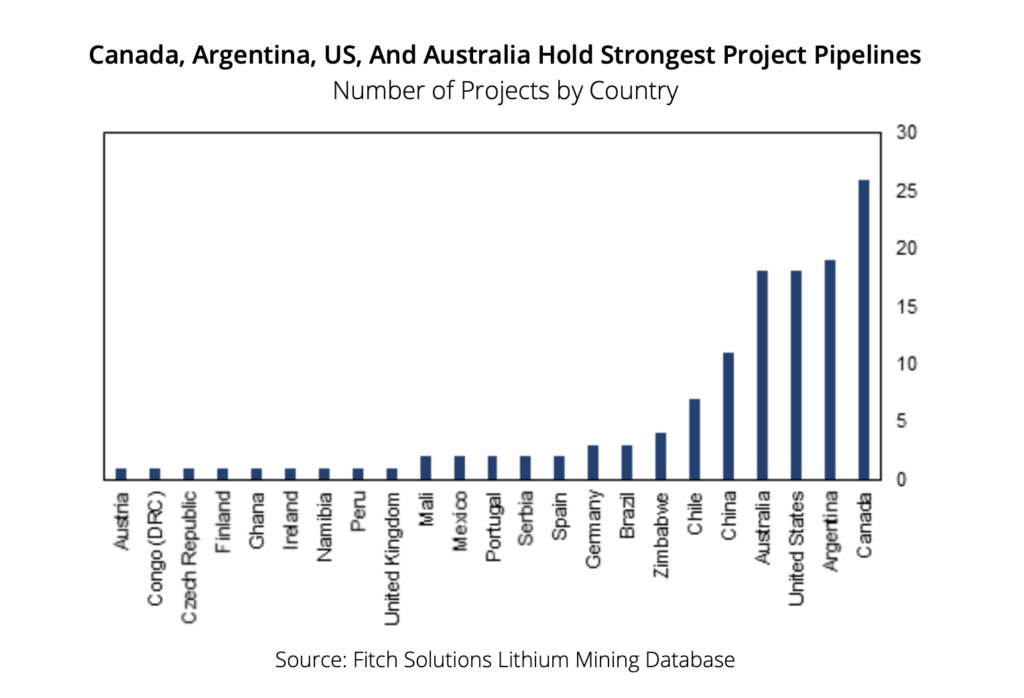

The pipeline of lithium projects is stronger in Canada, Argentina, the US, Australia, China and Chile.

However, moving a project to production has a plethora of challenges, and in any case, most of these are years away from production.

Goldman Sachs and Credit Suisse have recently reported bearish stances, while JP Morgan sees both sides, and UBS sees strong demand for the metals fueling the energy transition (noted, without mentioning lithium specifically).

If you missed it, here’s a thread with the breakdown.

That’s a wrap!

Stay tuned as I’ll be writing more about demand in the coming days.

For exposure, you may consider:

🔹 Lithium Americas Corp. | LAC

🔹 SAYONA MINING LIMITED | SYA

🔹 LEPIDICO LTD | LPD

🔹 CleanTech Lithium Plc | CTL

🔹 LITHIUM POWER INTERNATIONAL LIMITED | LPI

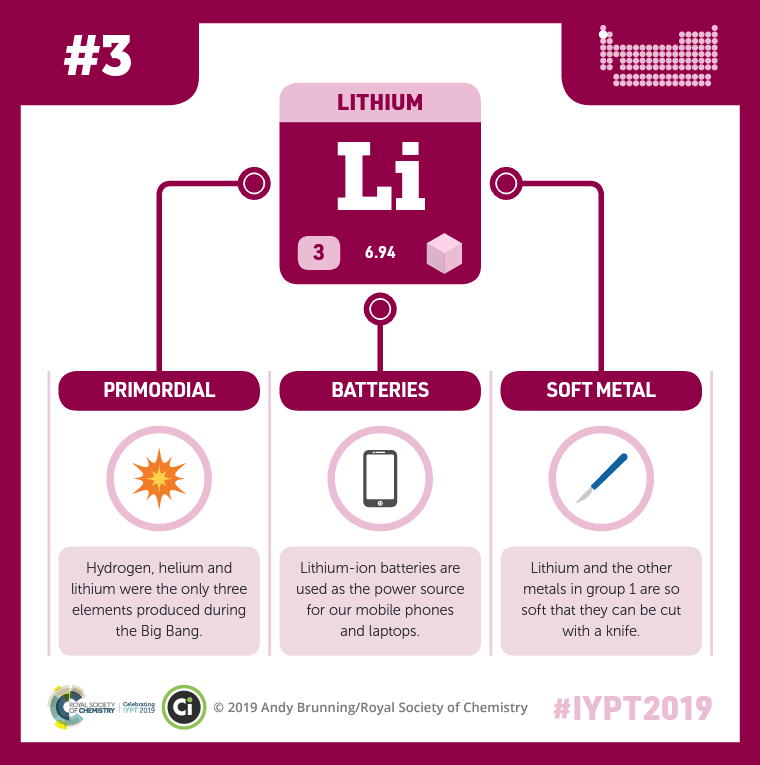

Lithium is used mostly for batteries for mobile phones, laptops, digital cameras and electric vehicles. Can be made into alloys with aluminium and magnesium, improving strength and making them lighter. A magnesium-lithium alloy is used for armour plating, while aluminium-lithium alloys are used in aircraft, bicycle frames and high-speed trains. Miners produce either carbonate or hydroxide which is then sold to refineries.

Keen to dig deeper? Here are some resources for you:

- Benchmark Mineral Intelligence

- International Lithium Association

- Shanghai Metals Market

- Lithium by Geoscience Australia

- Lithium facts by Natural Resources Canada

- Lithium pricing by Trading Economics

- Lithium by London Metal Exchange

- The World’s Largest Lithium Producers by Global Data

- Lithium Production by Country by Visual Capitalist

Want to see what I’ve been saying about it? From the serious to the funny and everything in between.

Have a related question? Pop it below. I’ll add to future topics to cover in my content.

Here’s the metal in the periodic table:

Note: assume I/we hold some if not all stocks mentioned on this website and social media.

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.