How to identify acquisition opportunities?

Mining projects often change hands between exploration and production.

This is due to the industry’s long life cycle and market swings.

Here’s a list of platforms that help companies, investors and vendors complete transactions:

🎯 Mines Online

Investors can browse for free, while vendors pay a 5% success fee or a negotiated upfront posting fee.

Backed by @ArgonautLimited

Home

🎯 Global Data

They gather publicly available data (32,000+ Mines and projects dating back to 2010).

Investors can request a demo of the platform and discuss pricing.

https://www.globaldata.com/marketplace/mining/mining-projects/

🎯 Digbee

@digbee collects publicly available data using proprietary AI and provides an ESG scoring framework.

Data can be accessed for free, while companies must register and pay a fee to get assessed and receive an ESG score.

🎯 Mineral Intelligence

Investors search among available listings.

Free for vendors, investors pay a subscription (not listed).

https://mineralintelligence.com/

🎯 Mineral Project Source

Another listing platform.

Vendors and buyers pay a subscription fee. There’s no success fee.

By @geomarvel

https://mineralprojectsource.com/

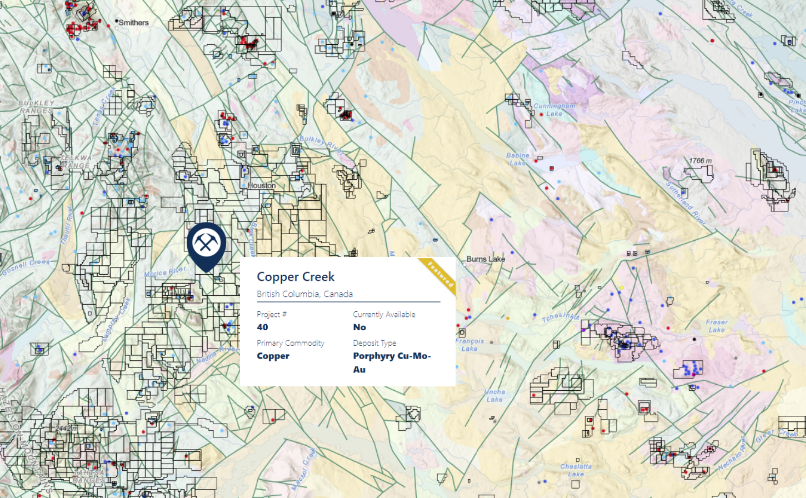

🎯 SearchSpace GEO

@SearchSpaceGeo collects publicly available project information.

Vendors can claim existing listings for a subscription fee. Investors can browse for free.

Mostly North American listings.

https://www.searchspacegeo.com/

🎯 Prospector

Investors get a subscription to access @ProspectorAI over 10,000 mining projects and companies, including 43101 reports, powered by AI.

Listed companies can pay an advertising fee to be highlighted.

https://www.prospectorportal.com/

🎯 GoldDiscovery

This one has just gone on beta. A bit similar to Global Data, so far.

Investors can sign up for a free account.

🎯 Mineral Opportunities

If you’re based in Chile, you may want to try a local solution. Vendors pay a fee to list and complete a transaction.

https://www.mineralopportunities.com/en/home/

And that’s a wrap!

Transactions are hard work but highly rewarding. We love working with clients and partners in that space, both sell and buy-side.

🎯 Seeking assets? Let’s chat:

💵 Selling your project? Submit for review here:

That’s it for today.

Every week we share our views on metals and mining stocks on socials and this blog. Subscribe here for highlights or join our distribution list for investment opportunities.

Before you go…

- Keen to reach +30K people? Let’s book an exploratory call

- Seeking acquisitions? Have a sneak peek of our deal flow pipeline

Synergy Resource Capital is a boutique investment and corporate advisory firm focused on natural resources and technology, and based in Sydney.

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.