Silver gets a cold shoulder from many in the investment community. But the precious metal is shifting.

Here are 5 reasons to add silver stocks to your portfolio, today and for the long term:

Hey hey! I’m Paola Rojas. I’ve been investing for 17 years, and as a corporate advisor to miners and investors have worked on over $80m in deals. Most of my work has been focused on the metals and minerals used in the energy transition. But I digress. Let’s keep going!

1) Demand for silver is rising steeply

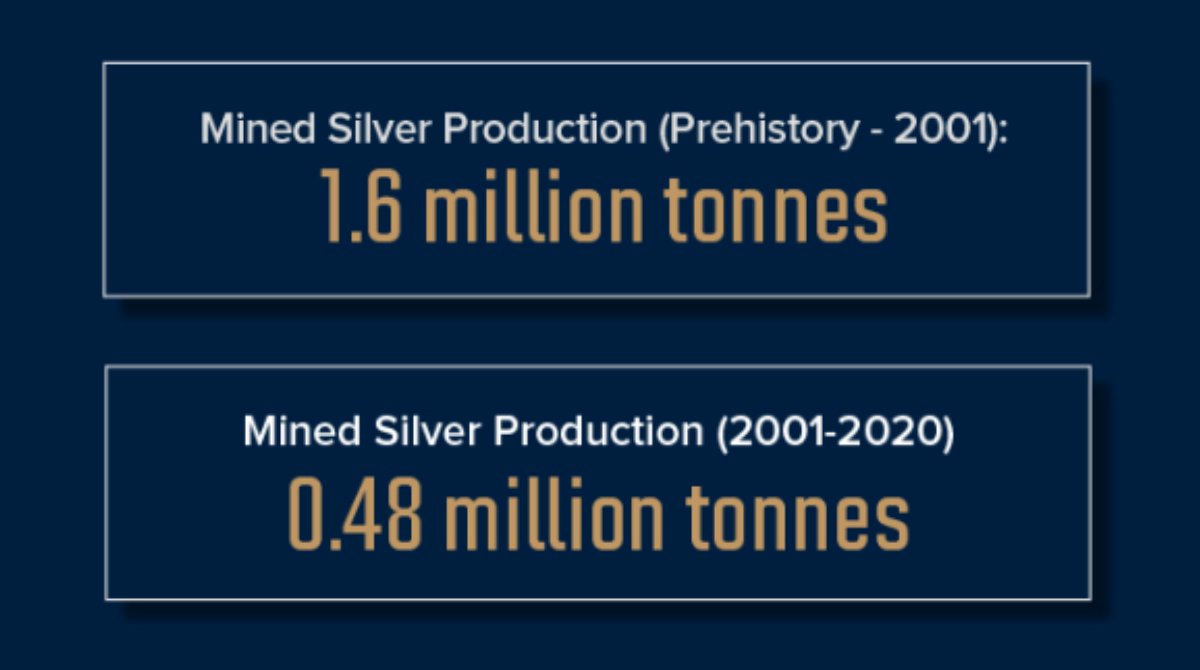

For starters, we are mining so much more silver, that in the last 2 decades we’ve mined ~1/3 of all previous production.

Talk about evolution!

But this is not the most surprising bit.

2) The biggest mines are getting old

The average age of the top 10 silver mines is almost 30 years.

Granted, primary silver mines are the turtles of the sector (think $FRES Fresnillo operating since the 1500s or Aguilar, operated for 90y).

Alas, not all mines can be 🐢

3) Supply has challenges

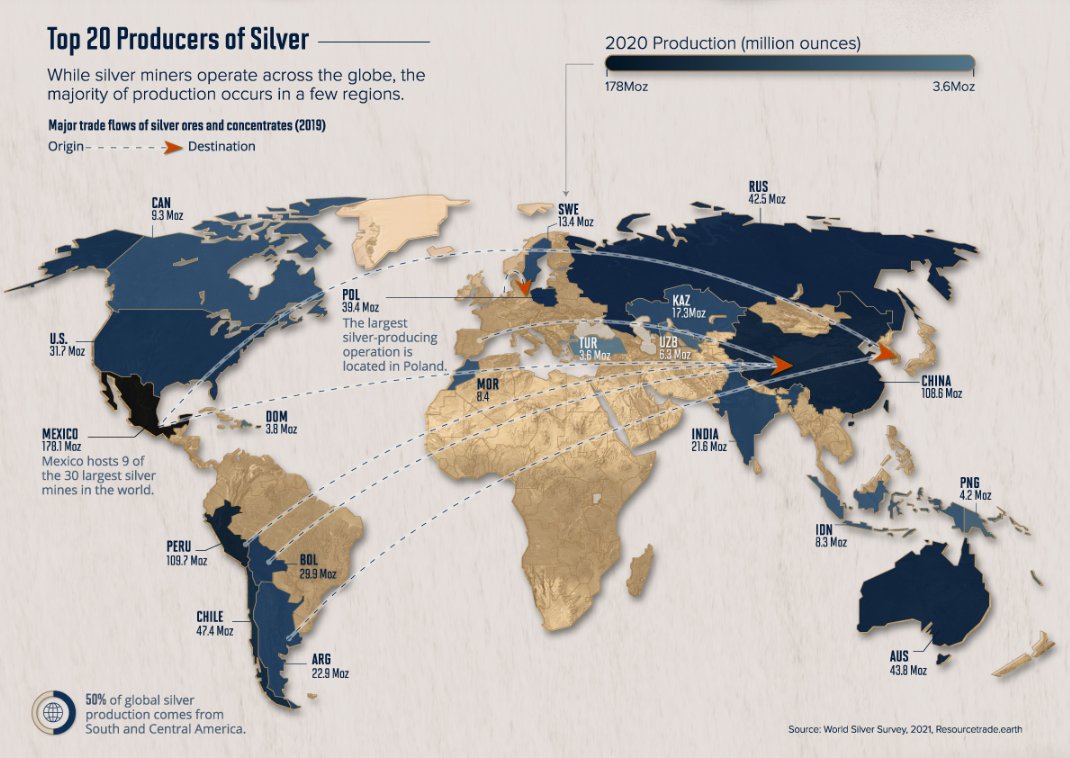

Most of the $silver production comes from regions that face growing pains and political swings, including countries in Latin America, Russia, and China.

This puts a significant part of the metal’s supply at risk.

4) Small market

If you look at the whole metals market globally, silver is still a small portion.

Bigger than lithium but still tiny.

While iron, copper & aluminium dominate, silver still has plenty of upside for investors.

And finally…

5) Serious misconception

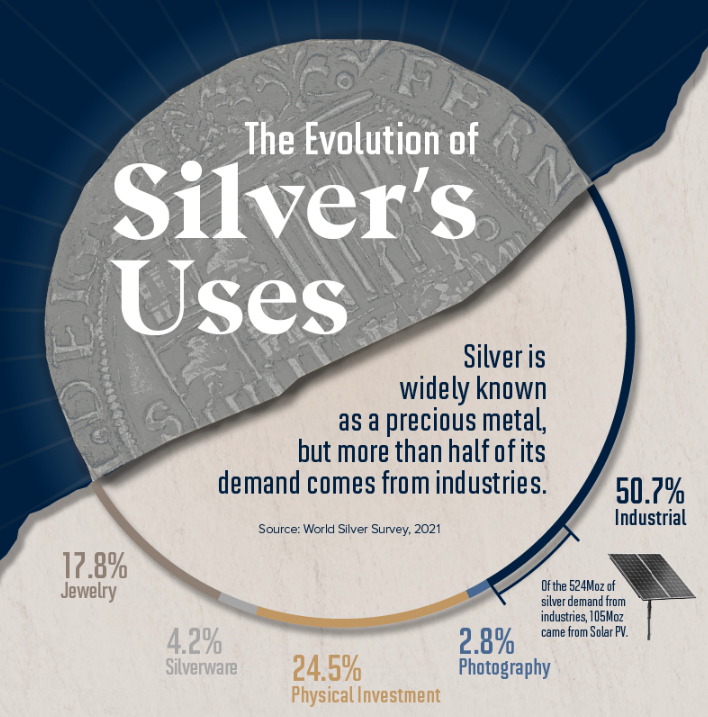

Despite its image of being used mostly for decoration and as a physical investment, shifts in electrification, solar adoption and technology mean that more silver is used in industry and photography.

Yes. MORE.

And that’s it!

Investing in silver, particularly when markets are turbulent, is a long-term bet. Use this list to guide your research.

1) Demand

2) Aging mines

3) Supply challenges

4) Plenty of upside left

5) Misconception galore for silver

If you enjoyed this…

- Subscribe for FREE weekly insights

Or read the latest posts

Disclaimer: Opinions and materials presented are not investment or financial advice and are intended for informational and educational purposes only; please consult a financial advisor before investing. Companies mentioned publicly may be held and/or clients, except within the member section. Content might contain affiliate links. By reading or sharing, you agree to our full disclaimer.

Accredited investor, corporate? Join Synergy Resource Capital’s distribution list for deal alerts and updates.