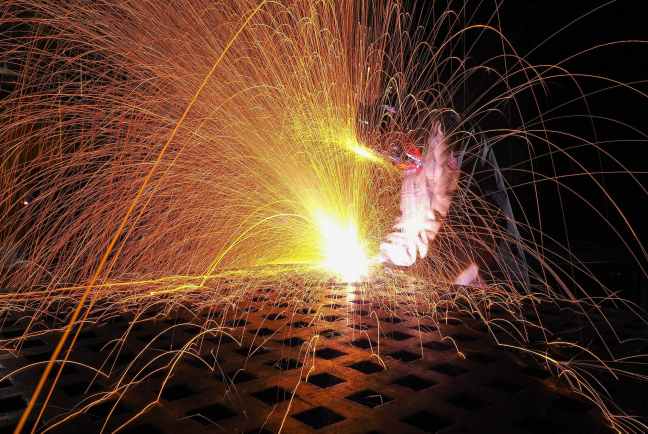

Top investment banks assumed they knew what was coming for copper in 2024. But things have changed over the last few weeks. BMO, Deutsche Bank and others say we're in for a surprise: During LME Week in October, sentiment was gloomy. ICSG even forecasted a surplus of nearly half a million metric tons. Large mine … Continue reading Here’s exactly where copper is headed in 2024… buckle up!

Here’s exactly where copper is headed in 2024… buckle up!