(Hint: it relates to commodities and mining)

Here’s something you may not know about Australia

If you’re considering whether to invest in metals & mining, you’re in the right place.

(Hint: it relates to commodities and mining)

Niobium is the critical metal you never heard of. And there is a funny reason...

Gold had a cracking 2024. It reached an all-time high just below $2,780 in October, closing the year just above $2,600. Analysts expected it to end the year around the $2,700 mark. It almost did. Beyond that horizon…

Gold is soaring due to geopolitics chaos and overall uncertainty. Precious metals -and gold in particular- are considered a flight to quality move for investors. Given the pain is not over... Here's your “Gold Investing 101” to help you get started:

As mining investors, we're always hunting for information. While I don't believe in copying anyone's thesis, paying close attention to sentiment is paramount. Here are some of my favourite quotes on commodities (including copper and lithium): → Via @LowellResFM $LRFM You can't do anything without copper! Lowell runs an exploration fund with exposure to $MKG … Continue reading 10 of the best recent commodity investing quotes (that we can learn from)

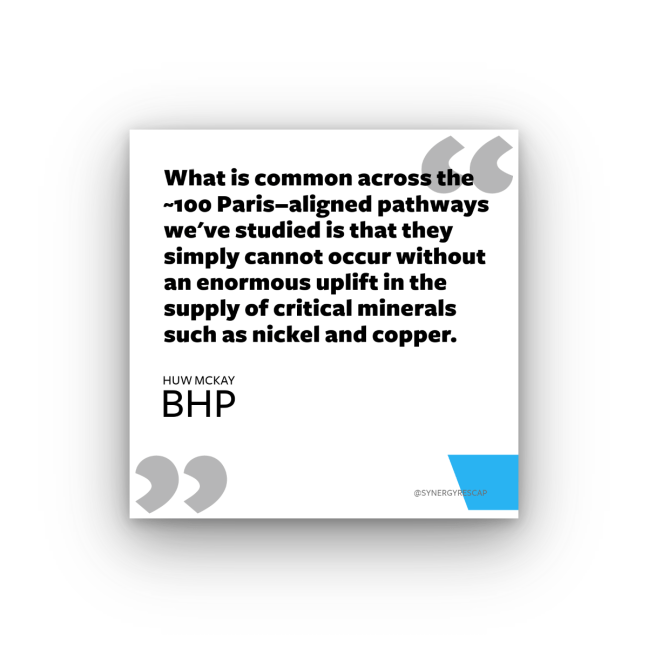

Investment in the energy transition beat another record in 2023, up 17% on the previous year. Renewables and the grid are a fundamental piece of the theme. Here are clues and stock ideas on how you, as an investor, can participate in both: Global investment in the energy transition hit $1.77 trillion in 2023 A … Continue reading The energy transition is winning (and here’s how you can, too, investor)

Investing in mining and metals is a long-term passion of mine. Over the last 18 months, I posted several 101s and bull cases for most metals and minerals in our criteria to help others get started. Here are the best:

Copper is the most important metal. While prices have been weak recently, this remains true: No copper, no energy transition! Hence, here's your “Copper Investing 101” to help you start or expand your exposure:

Nuclear remains deeply controversial. Yet recent geopolitic struggles have reignited the flame sending uranium (and many related stocks, producers and explorers alike) higher. There are many reasons to be bullish:

Rare earths are in fact, not rare. This niche mining market was recently forecast to grow by 6x by 2030. But geopolitics are complicating it all for investors. Here's your REEs 101 (to enter or better understand this unique sector):

Graphite is the most overlooked battery mineral. Lithium gets more eyeballs, yet it makes sense for investors to pay attention to its neighbour. Here are 5 reasons to add graphite to your portfolio (plus some promising graphite stocks):

The top 60 automakers are worth ~$2.1T. The top 15, led by $TSLA, account for 79%. As the sector races to secure supply of lithium and other metals, EV-related investments skyrocketed. The leaders are putting serious $ at play. Here's your recap of deals and the rationale behind them: Unsurprisingly, the top 15 pack is … Continue reading Automakers are chasing metals and minerals (like you’ve never seen before)

Major players such as BHP and RIO have been saying this for a while. The amount of metals and minerals required for the energy transition is massive. Only 1 thing to do: more investment. Here are 5 basic strategies to start (or expand) your allocation: For reference, even the largest miners can't hold a candle … Continue reading How to Start Investing in the Energy Transition

Copper pricing has weakened due to expected falling demand. But in the long term, we need the metal 😎 Here are my 5 favourite reasons to add copper to your portfolio: 1) Rising demand for EVs and decarbonisation fuels the need for metals used in electrification, including: • lithium • copper • nickel • cobalt … Continue reading 5 fundamental reasons to add copper to your mining & metals portfolio

We live in a mineral-intensive world, yet many investors are on the fence about the sector. If that's you, here my reasons to gain exposure to mining and metals (there are many but I will give you my top 5):

Lithium is the core of the batteries we use daily. Critical minerals will continue expanding as the energy transition speeds up. Here's your “Lithium Investing 101” to help you venture into this growing theme.

Silver gets a cold shoulder from many in the investment community. But the precious metal is shifting. Here are 5 reasons to add silver stocks to your portfolio for the long term:

The energy transition is upon us, whether you like it or not. So... here are 5 reasons you SHOULD consider investing in lithium, today and for the long term: 1) To start, rising quantities of batteries are desperately needed to push electrification forward. Electric vehicles require efficient and lightweight power storage (aka batteries) that can … Continue reading These 5 reasons to invest in lithium stocks are all you need to know to add the metal to your portfolio

Investing in natural resources can be rewarding but it does have its challenges. There are lots of technical terms to understand, resources are sometimes located in risky & distant jurisdictions and from 100 exploration projects, less than 1 will become a mine. Yes, tough odds, but if you happen to buy into a company when … Continue reading The puzzle of investing in gold stocks: 5 things you must know before jumping in

Well, if you've read any of my previous posts or follow me in any of my socials, you may already have assumed what I am about to say. But bear with me... I have my reasons! Yes, I do believe you need natural resources. Shocker! Where do I start? There are certainly many reasons but I … Continue reading Should you have natural resources in your stock portfolio? Like, really??